March 28, 2023

Top Banking as a Service (BaaS) Providers

In today's fast-paced digital world, businesses are constantly seeking innovative solutions to streamline their operations and enhance customer experiences. One area where this is particularly evident is in the banking industry. Traditional banking models are slowly being replaced by more agile, digitally-driven approaches, and Banking as a Service (BaaS) is at the forefront of this transformation.

Understanding Banking as a Service (BaaS)

From our experience at Artkai, we have witnessed the rise of BaaS and its impact on the financial industry. But what exactly is BaaS, and how does it work?

BaaS, or Banking as a Service, is a relatively new concept in the world of finance. It is a model that allows third-party companies to offer banking services to their customers, without having to become a licensed bank themselves. Instead, these services are provided through Application Programming Interfaces (APIs), which enable seamless integration between the third-party platform and the banking infrastructure.

One of the key benefits of BaaS is that it allows businesses to easily access banking services to support their operations, without the need for extensive IT infrastructure. This means that companies can focus on their core competencies, while leaving the banking services to the experts.

Consumers, on the other hand, can enjoy a better user experience with BaaS, with faster and more seamless transactions. This is because BaaS providers are able to offer a range of services that are tailored to the needs of their customers, without the need for expensive and complex banking systems.

Benefits of BaaS for Businesses and Consumers

For businesses, BaaS offers a range of benefits. Firstly, it allows them to access banking services quickly and easily, without the need for extensive IT infrastructure. This means that companies can focus on their core competencies, while leaving the banking services to the experts. Secondly, BaaS providers are able to offer a range of services that are tailored to the needs of their customers, without the need for expensive and complex banking systems.

For consumers, BaaS offers a better user experience, with faster and more seamless transactions. This is because BaaS providers are able to offer a range of services that are tailored to the needs of their customers, without the need for expensive and complex banking systems. This means that consumers can enjoy a better user experience, with faster and more seamless transactions.

Key Components of BaaS

There are three key components that make up BaaS:

- The banking infrastructure: This includes all the services and functionalities typically offered by banks, including account opening, balance information, transaction management, and other financial services. The banking infrastructure is the backbone of the BaaS model, providing the essential services that are required for the model to work.

- The API gateway: This is the link between the third-party platform and the banking infrastructure. It enables secure and reliable data exchange between the two entities, without compromising customer privacy and security. The API gateway is an essential component of the BaaS model, providing the necessary security and privacy features that are required for the model to work.

- The third-party application: This is the digital platform that offers banking services to its customers, using the APIs provided by the banking infrastructure. The third-party application is the face of the BaaS model, providing the user interface and user experience that customers interact with.

In conclusion, BaaS is an innovative model that allows third-party companies to offer banking services to their customers, without having to become a licensed bank themselves. It offers a range of benefits to businesses and consumers, and is made up of three key components: the banking infrastructure, the API gateway, and the third-party application.

Top BaaS Providers

In today's fast-paced world, businesses are constantly looking for ways to streamline their operations and improve their customer experience. One way to do this is by using BaaS (Backend as a Service) APIs, which provide businesses with access to a range of financial services, such as digital banking, payment processing, and transaction management. There are many BaaS providers in the market today, each offering their own unique set of features and benefits.

From our experience at Artkai, we have worked with some of the most innovative and reliable companies in this space. Below are some of the top BaaS API providers:

Solarisbank

Solarisbank is a Berlin-based BaaS provider that offers banking solutions to businesses across Europe. The company offers a wide range of financial services, such as digital banking, issuing of credit cards, and smart financing solutions. It boasts a robust banking infrastructure and flexible API gateway that enables seamless integration with third-party platforms.

One of the key benefits of using Solarisbank is its ability to provide businesses with access to a range of financial services, all from a single platform. This can help businesses save time and money, as they no longer need to manage multiple banking relationships. Additionally, Solarisbank's API gateway is easy to use, making it simple for businesses to integrate its banking infrastructure into their platforms.

Railsbank

Another BaaS provider that we have worked with at Artkai is Railsbank. This London-based company offers a full-stack banking platform that allows businesses to create their own financial products and services. It boasts an intuitive and easy-to-use API gateway that provides real-time access to banking services.

One of the key benefits of using Railsbank is its ability to provide businesses with complete control over their financial products and services. This can help businesses differentiate themselves in the market and create unique offerings for their customers. Additionally, Railsbank's API gateway is highly customizable, allowing businesses to tailor its banking infrastructure to their specific needs.

Starling Bank

Starling Bank is a UK-based digital bank that offers BaaS APIs to businesses across Europe. The company offers a range of innovative financial services, including digital money management tools, real-time transaction tracking, and fast payment processing. Its API gateway is easy to use, and it provides excellent customer support to its clients.

One of the key benefits of using Starling Bank is its focus on providing businesses with access to innovative financial services. This can help businesses stay ahead of the competition and provide their customers with a superior experience. Additionally, Starling Bank's API gateway is highly reliable, ensuring that businesses can always access the banking services they need.

ClearBank

ClearBank is a UK-based Banking-as-a-service provider that focuses on providing banking services to fintech companies and financial institutions. The company offers a highly secure and reliable banking infrastructure, with a robust API gateway that allows easy integration with third-party platforms. It offers a range of financial services, including real-time payments and transaction management.

One of the key benefits of using ClearBank is its focus on providing banking services to fintech companies and financial institutions. This can help businesses in these industries access the banking services they need to grow and succeed. Additionally, ClearBank's API gateway is highly secure, ensuring that businesses can trust its banking infrastructure with their sensitive financial data.

Bankable

Bankable is a UK-based BaaS provider that offers banking solutions to businesses across Europe. The company provides a full-stack banking platform that enables businesses to create their own financial products and services. Its API gateway is flexible and scalable, allowing seamless integration with third-party platforms.

One of the key benefits of using Bankable is its focus on providing businesses with complete control over their financial products and services. This can help businesses differentiate themselves in the market and create unique offerings for their customers. Additionally, Bankable's API gateway is highly scalable, ensuring that businesses can easily grow and expand their use of its banking infrastructure over time.

Dwolla

Dwolla is a US-based Banking-as-a-service provider that offers payment solutions to businesses across industries. The company provides a robust and secure banking infrastructure, with a flexible API gateway that enables real-time transactions and low-cost fees. It offers a range of financial services, including instant bank transfers and mass payments.

One of the key benefits of using Dwolla is its focus on providing businesses with low-cost payment solutions. This can help businesses save money on transaction fees and improve their bottom line. Additionally, Dwolla's API gateway is highly flexible, allowing businesses to customize its banking infrastructure to their specific needs.

Fidor Bank

Fidor Bank is a German-based digital bank that offers BaaS APIs to businesses across Europe. The company provides a range of innovative financial services, including mobile banking, API banking, and digital payments. Its API gateway is flexible and scalable, allowing businesses to easily integrate its banking infrastructure into their platforms.

One of the key benefits of using Fidor Bank is its focus on providing businesses with access to innovative financial services. This can help businesses stay ahead of the competition and provide their customers with a superior experience. Additionally, Fidor Bank's API gateway is highly customizable, allowing businesses to tailor its banking infrastructure to their specific needs.

Marqeta

Marqeta is a US-based BaaS provider that offers payment solutions to businesses across industries. The company provides an innovative banking infrastructure, with a flexible API gateway that enables real-time payment processing and easy integration with third-party platforms. It offers a range of financial services, including virtual cards and instant funding.

One of the key benefits of using Marqeta is its focus on providing businesses with access to innovative payment solutions. This can help businesses stay ahead of the competition and provide their customers with a superior experience. Additionally, Marqeta's API gateway is highly reliable, ensuring that businesses can always access the banking services they need.

Comparing BaaS Providers

When evaluating BaaS API providers, there are several factors to consider. From our experience at Artkai, we have identified the following key criteria:

Pricing and Fee Structures

Businesses need to consider the pricing and fee structures of BaaS API providers to ensure that they are getting value for their money. Some companies charge a fee per transaction, while others charge a flat monthly fee. Businesses should evaluate the pricing models of different providers to determine which one is most suitable for their needs.

It's important to note that the cheapest option may not always be the best choice. Some providers may offer lower fees, but they may have hidden costs or limited functionality. On the other hand, some providers may charge higher fees but offer more comprehensive services and features that can significantly benefit businesses in the long run.

Geographic Coverage and Expansion

Businesses operating in different regions need to consider the geographic coverage of providers. Some providers may offer services only in specific regions, while others may have a global presence. This is particularly important for businesses that are looking to expand to new markets in the future.

When evaluating the geographic coverage of Banking-as-a-service providers, businesses should also consider the provider's network infrastructure. Providers with a more extensive network infrastructure can offer faster and more reliable services, which can be crucial for businesses that rely on real-time transactions.

API Functionality and Features

API functionality and features are another critical factor to consider when evaluating companies. Businesses need to ensure that the API gateway is easy to use, secure, and reliable. They should also evaluate the range of financial services offered by the provider and ensure that they align with their business needs.

Some providers may offer more advanced features, such as real-time analytics and reporting, which can provide businesses with valuable insights into their financial operations. Other providers may offer more basic features but may be more suitable for businesses with simpler financial needs.

Integration and Developer Support

Integration and developer support are important factors to consider when choosing a Banking-as-a-service provider. Businesses need to ensure that the provider offers easy integration with their existing platforms and provides adequate developer support to resolve any technical issues that may arise.

Providers with a robust developer community can provide businesses with access to a wealth of technical expertise and resources, which can be invaluable when integrating the provider's services into their existing systems. Additionally, providers that offer comprehensive documentation and support can help businesses save time and resources when implementing the provider's services.

Security and Compliance

Security and compliance are critical factors to consider when evaluating BaaS providers. Businesses need to ensure that the provider is compliant with relevant regulations and standards, such as GDPR and PCI DSS. They should also evaluate the provider's security protocols and ensure that they are adequate to protect customer data.

Some providers may offer additional security features, such as multi-factor authentication and data encryption, which can provide businesses with an extra layer of protection against security threats. Additionally, providers that offer regular security audits and compliance checks can help businesses ensure that their financial operations are always in compliance with industry standards and regulations.

Use Cases and Success Stories

From our experience at Artkai, we have seen several success stories of businesses leveraging BaaS API providers. Below are some examples:

Fintech Startups Leveraging BaaS

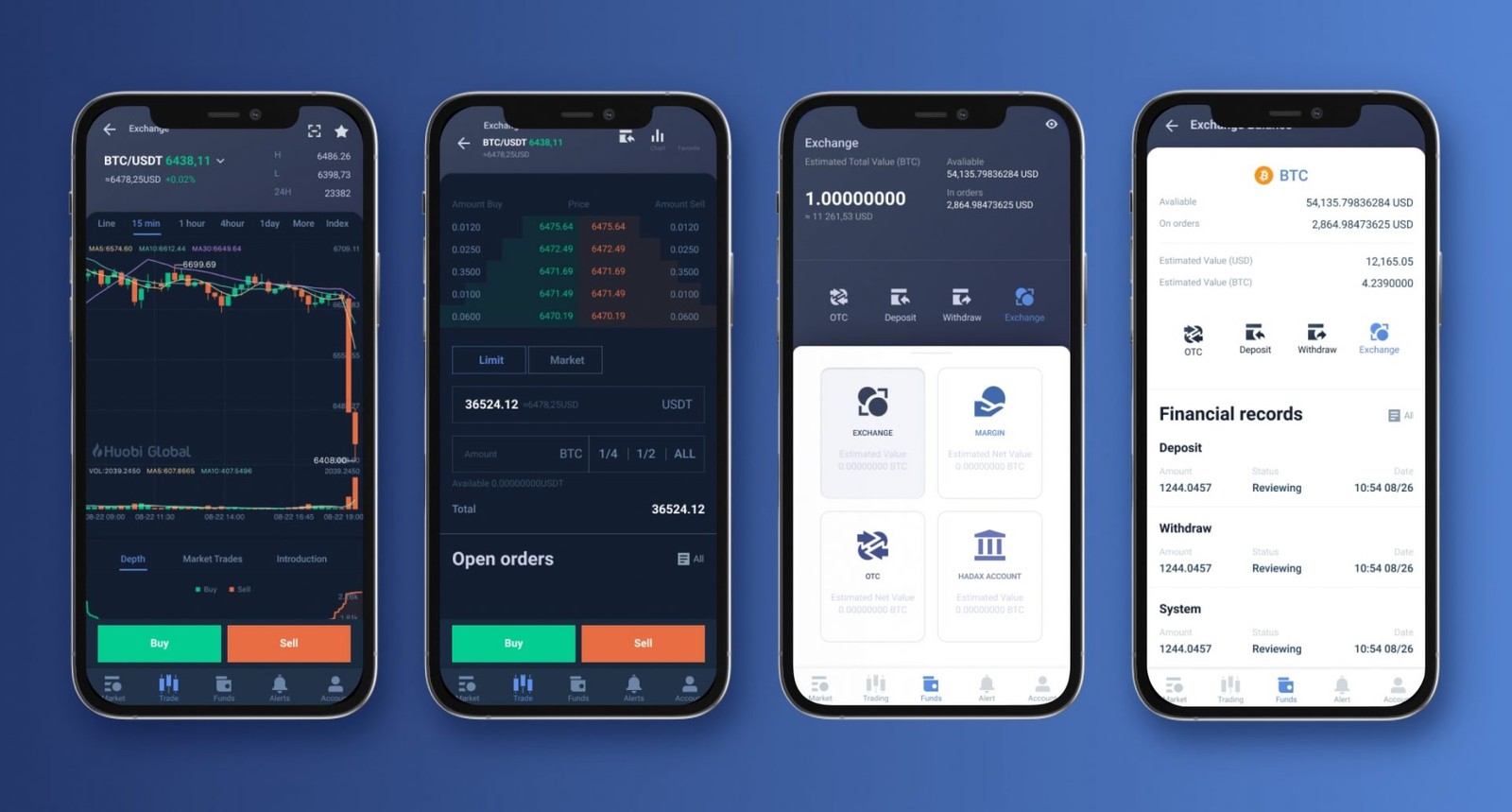

Fintech startups such as Huobi, a mobile trading platform, have leveraged BaaS to offer innovative financial services to their customers. By partnering with BaaS API providers such as ClearBank, they have been able to offer real-time payments, low-cost fees, and flexible transaction management tools.

For example, Huobi was able to offer its customers instant access to their funds, enabling them to make trades faster and with greater ease. This was made possible through ClearBank's BaaS solution, which provided Huobi with the necessary infrastructure to process transactions in real-time.

In addition, BaaS has allowed fintech startups like Huobi to offer more flexible transaction management tools, such as the ability to set up recurring payments or to automate certain transactions. This has made it easier for customers to manage their finances and has helped to improve overall customer satisfaction.

Screens

Traditional Banks Adopting BaaS Solutions

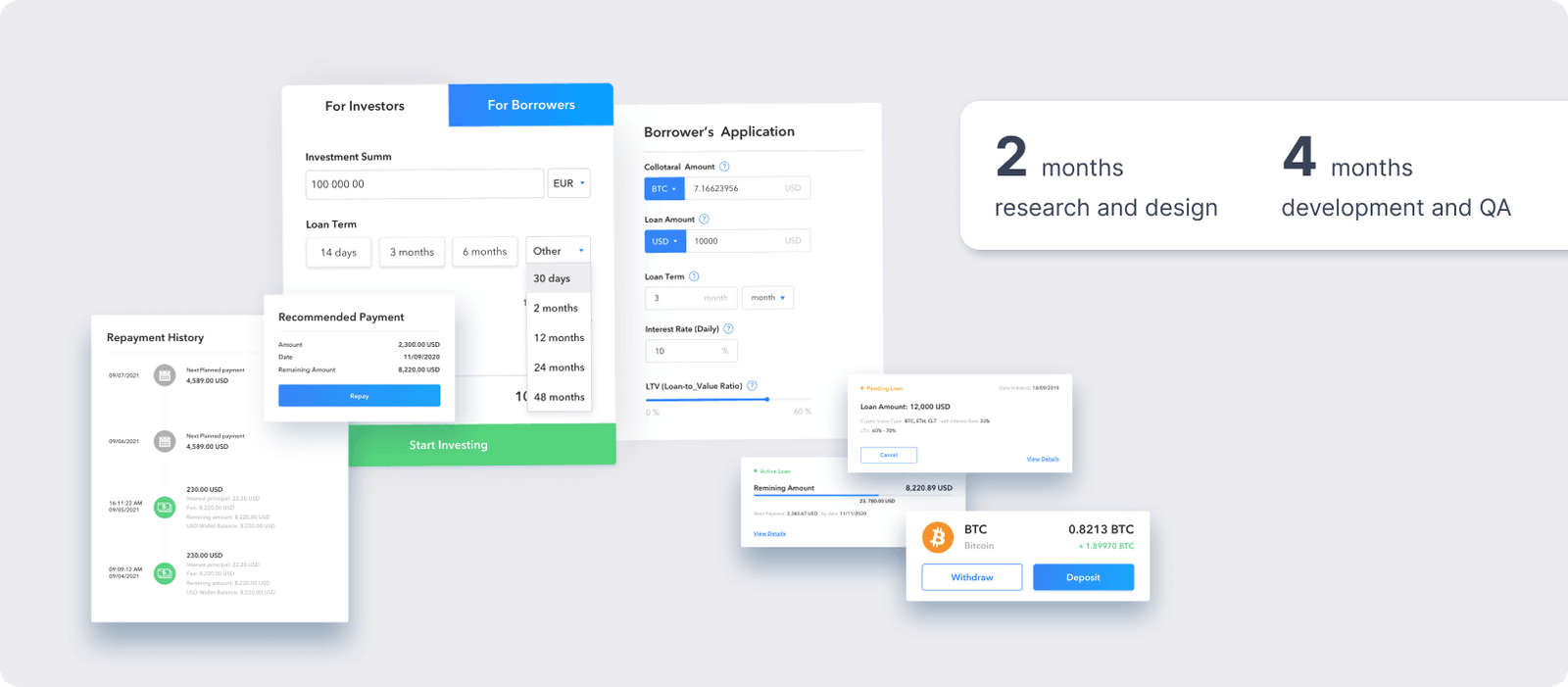

Traditional banks such as CoinLoan have also adopted BaaS solutions to enhance their operations and customer experiences. By partnering with BaaS API providers such as Bankable, they have been able to offer digital banking services, real-time transactions, and innovative financing solutions to their customers.

For example, Bankable's BaaS solution enabled CoinLoan to offer real-time transactions to its customers, allowing them to transfer funds instantly and securely. This helped to improve customer satisfaction and loyalty, as customers were able to access their funds more quickly and easily than ever before.

In addition, BaaS has allowed traditional banks like CoinLoan to offer innovative financing solutions, such as peer-to-peer lending and crowdfunding. This has helped to democratize access to finance and has enabled more people to access the funding they need to start or grow their businesses.

E-commerce and Retail Applications

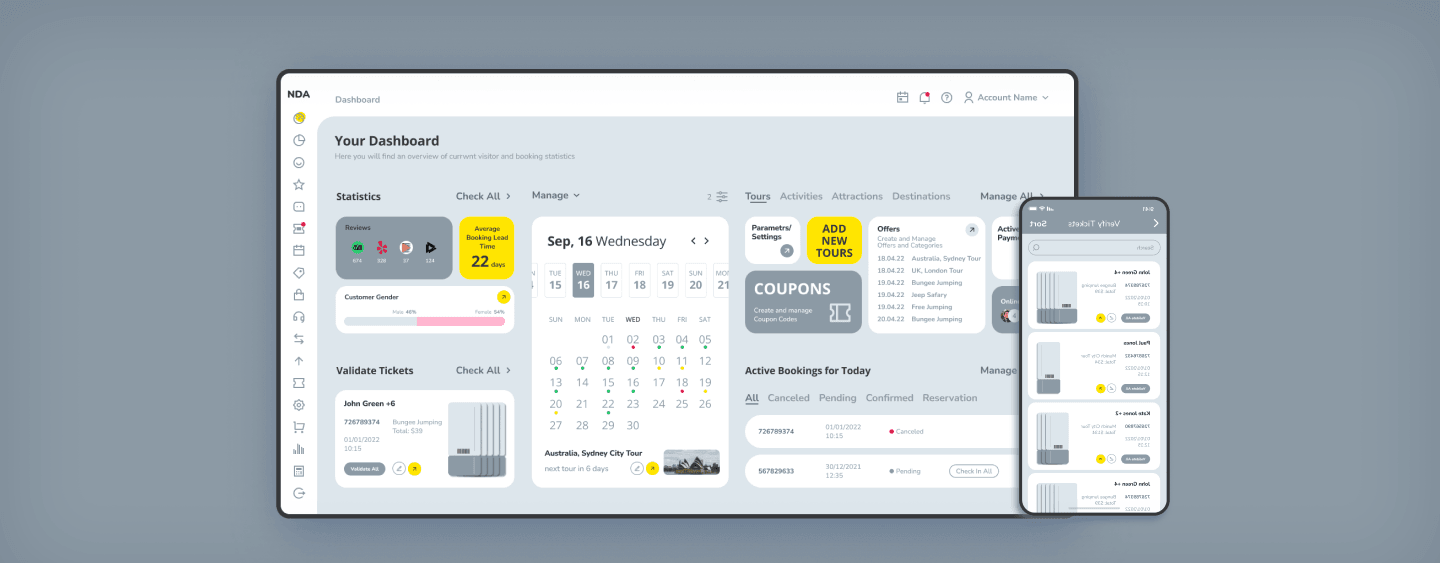

E-commerce and retail applications such as NDA Booking, an all-in-one solution for the travel industry, have leveraged BaaS to offer seamless payment processing and secure transactions. By partnering with BaaS API providers such as Dwolla, they have been able to reduce costs, simplify payment processing, and enhance customer experiences.

For example, Dwolla's BaaS solution enabled NDA Booking to process payments more quickly and securely, reducing the risk of fraud and ensuring that transactions were completed smoothly. This helped to improve customer satisfaction and loyalty, as customers were able to book their travel arrangements with greater ease and confidence.

In addition, BaaS has allowed e-commerce and retail applications like NDA Booking to reduce costs associated with payment processing, such as transaction fees and chargebacks. This has helped to improve profit margins and has enabled businesses to invest more in other areas of their operations, such as marketing and product development.

Cross-border Payments and Remittances

Cross-border payments and remittances have also been transformed by BaaS. Through partnerships with BaaS API providers such as Railsbank and Fidor Bank, businesses have been able to offer real-time transfers, low-cost fees, and secure transactions across borders.

For example, Railsbank's BaaS solution enabled businesses to offer real-time transfers across borders, reducing the time and cost associated with traditional cross-border payments. This has helped to improve access to finance for people in developing countries, enabling them to receive and send money more quickly and easily than ever before.

In addition, BaaS has allowed businesses to offer low-cost fees for cross-border payments and remittances, making it more affordable for people to access the financial services they need. This has helped to improve financial inclusion and has enabled more people to participate in the global economy.

The Future of Banking as a Service

As BaaS adoption continues to grow, there are several emerging trends and potential challenges to be aware of. From our experience at Artkai, we have identified the following:

Emerging Trends in BaaS

Emphasis on customer experience, hybrid banking models, and platformization are the emerging trends that we have noted in BaaS.

Potential Challenges and Risks

The potential challenges and risks associated with BaaS include regulatory compliance, data privacy, cybersecurity, and risk management.

Opportunities for Growth and Innovation

Despite these challenges, BaaS presents significant opportunities for growth and innovation in the financial industry. By leveraging BaaS, businesses can offer innovative financial services to their customers, reduce costs, and enhance their competitiveness in the market.

To sum up

Overall, BaaS providers offer great opportunities for businesses, consumers, and the financial industry as a whole. From our experience at Artkai, we have identified several top providers that provide reliable and innovative financial services.

If you are interested in exploring BaaS for your business, feel free to contact us.

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.