March 04, 2023

What Are the Steps to Creating a Mobile Banking App?

In the age of digital transformation, mobile banking apps have become an essential tool for financial institutions to monitor customer behavior, improve engagement, and stay ahead of the curve. Developing a successful mobile bank app requires a structured approach that considers every aspect of the user experience, functionality, and security.

Our team has developed more than 10 successful banking solutions, and now we'd like to share our experience and tips with you. So get yourself comfortable, and let's get started.

Understanding the Basics of Mobile Banking Apps

Before diving into the process of creating a mobile bank app for your financial institution, it's important to understand the basics of mobile banking apps. In essence, a mobile banking app is a software application that enables customers to access their bank accounts and perform financial transactions, such as deposits, transfers, and bill payments.

What is a Mobile Banking App?

A mobile banking app is a digital solution that provides secure access to a customer's bank account information through their mobile device. It enables customers to manage their finances on-the-go, 24/7, and from anywhere in the world.

Benefits of Mobile Banking Apps

The benefits of mobile banking apps are manifold. They include convenience, speed, accessibility, and ease of use. Mobile banking apps allow customers to access their accounts and perform financial transactions without having to visit the bank physically.

One of the main benefits of mobile banking apps is that they save customers time. Instead of having to visit a bank branch, customers can simply use their mobile device to access their accounts and perform transactions. This means that customers can manage their finances on-the-go, without having to take time out of their busy schedules to visit a physical bank location.

Mobile banking apps also offer increased accessibility. With a mobile banking app, customers can access their accounts from anywhere in the world, as long as they have an internet connection. This means that customers can manage their finances while traveling, or even while sitting at home in their pajamas.

Another benefit of mobile banking apps is that they are user-friendly. Most mobile banking apps have a simple and intuitive interface, making it easy for customers to navigate and perform transactions. Additionally, many mobile banking apps offer features such as budget tracking and financial planning tools, which can help customers better manage their finances.

Key Features of a Successful Mobile Banking App

The key features of a successful mobile banking app include a user-friendly interface, security measures such as biometric authentication, push notifications, and real-time account balance updates.

- One important feature of a successful mobile banking app is biometric authentication. Biometric authentication uses a customer's unique physical characteristics, such as their fingerprint or face, to verify their identity. This adds an extra layer of security to the app, helping to protect customers' sensitive financial information.

- Push notifications are another important feature of a successful mobile banking app. Push notifications can alert customers to important account activity, such as a large deposit or a bill payment due date. This helps customers stay on top of their finances and avoid any potential issues.

- Real-time account balance updates are also crucial for a successful mobile banking app. With real-time updates, customers can see their current account balance at any time, which can help them make informed financial decisions. Additionally, real-time updates can help customers avoid overdraft fees by alerting them when their account balance is low.

In conclusion, mobile banking apps are an essential tool for modern banking. They offer customers convenience, accessibility, and ease of use, while also providing security measures to protect customers' sensitive financial information. By incorporating key features such as biometric authentication, push notifications, and real-time account balance updates, financial institutions can create successful mobile banking apps that meet the needs of their customers.

Research and Market Analysis

Creating a mobile bank app is an exciting endeavor that requires careful planning and execution. One of the first steps in this process is conducting thorough research and market analysis to determine what your customers need. At Artkai, we believe that this involves identifying your target audience, analyzing competitors and market trends, and determining your unique selling proposition (USP).

Identifying Your Target Audience

Identifying your target audience is crucial to the success of your mobile banking app. This means developing a deep understanding of your customers' demographics, pain points, and financial behaviors. Conducting surveys, focus groups, and user tests are essential to gather valuable insights that will inform your app development process.

For example, you may find that your target audience consists of millennials who value convenience and accessibility. They may prefer a mobile banking app that allows them to manage their finances on-the-go, with features like mobile check deposit and real-time account updates.

Analyzing Competitors and Market Trends

Another important step in creating a mobile banking app is analyzing your competitors and market trends. This will help you identify gaps in the market that you can fill through your app. Look at your competitors' product offerings, features, and user interface to determine what works and what doesn't work.

For instance, you may find that your competitors offer a mobile banking app that lacks a personal finance management tool. This could be an opportunity for you to differentiate your app by providing a comprehensive personal finance management tool that helps users budget, save, and invest.

Determining the Unique Selling Proposition (USP)

After identifying your target audience and analyzing competitors and market trends, you should be able to determine your unique selling proposition (USP). Your USP should be unique, compelling, and relevant to your target audience. It should be something that sets your mobile banking app apart from the rest.

For example, your USP could be a feature that no other mobile banking app has, such as a virtual assistant that helps users make financial decisions based on their spending habits and financial goals. Alternatively, your USP could be a focus on security and privacy, with features like two-factor authentication and biometric login.

Overall, conducting thorough research and market analysis is crucial to creating a successful mobile banking app. By identifying your target audience, analyzing competitors and market trends, and determining your unique selling proposition, you can develop an app that meets the needs of your customers and stands out in a crowded market.

Defining the App's Functionalities and Features

Once you have a clear understanding of your target audience, competitors, and USP, it's time to define the functionalities and features of your mobile banking app.

However, it's important to note that the functionalities and features of your mobile banking app should not be limited to just the essential ones. You should also consider offering additional features that can set your app apart from your competitors and provide added value to your customers.

For example, you may want to consider offering features such as financial planning tools, investment advice, and personalized financial recommendations based on the user's spending habits and financial goals.

Essential Features for a Mobile Bank App

The essential features for a mobile bank app include account management, transaction history, bill payments, money transfers, and deposits. These features are the backbone of any mobile banking app and should be included in your app's core functionality.

However, it's important to keep in mind that these features should be designed in a way that is user-friendly and easy to understand. For example, the account management feature should allow users to view their account balances, transaction history, and other account details in a clear and concise manner.

In addition, the transaction history feature should be designed in a way that allows users to easily track their spending and identify any fraudulent activity on their account.

Security and Compliance Considerations

Security and compliance are critical considerations in mobile banking app development. As a customer-centric digital product development agency with a proven track record, we at Artkai understand these concerns. We ensure compliance with industry regulations such as GDPR, PCI, and other data privacy laws.

Additionally, we implement state-of-the-art security measures such as two-factor authentication, biometric authentication, and encryption to ensure that our clients' customers' data is secure and protected at all times.

User Experience and Interface Design

User experience (UX) and interface design are crucial for the success of any mobile banking app. The user interface (UI) should be intuitive, visually appealing, and easy to navigate. The user experience should be seamless and enjoyable, allowing customers to accomplish their financial tasks quickly and efficiently.

At Artkai, we understand the importance of user experience and interface design in mobile banking app development. Our team of experienced designers and developers work together to create a user-friendly and visually appealing interface that is tailored to our clients' customers' needs.

We also conduct extensive user testing to ensure that our designs are intuitive and easy to navigate, allowing our clients' customers to accomplish their financial tasks quickly and efficiently.

Assembling Your Development Team

Assembling the right development team is essential to create a mobile banking app that meets the needs and expectations of your customers. With the ever-evolving technological landscape, it is imperative to have a team of experts who can navigate the complex world of mobile app development.

When it comes to assembling your development team, you need to decide between an in-house team and outsourcing. Both options have their advantages and disadvantages, and your decision should depend on your business needs and budget.

In-house vs. Outsourcing

Outsourcing offers cost-effectiveness and access to a broader talent pool. You can choose from a vast pool of developers and designers from around the world, which can help you save costs and time. Outsourcing also allows you to focus on your core business functions while the development team takes care of the app development process. However, outsourcing can have some downsides, such as communication barriers, time zone differences, and cultural differences.

On the other hand, an in-house team provides better control and collaboration. You have direct access to the team, which can help you ensure that the project is going in the right direction. Additionally, an in-house team can work closely with other departments within your company, such as marketing and customer support. However, an in-house team can be more expensive, and it can be challenging to find the right talent for each role.

Key Roles and Responsibilities

Your development team should consist of a project manager, UX/UI designer, front-end developer, back-end developer, quality assurance engineer, and security consultant. Each role is essential to ensure that your mobile banking app is developed to the highest standards.

The project manager is responsible for overseeing the entire development process, ensuring that the project is on track and within budget. The UX/UI designer creates the look and feel of the app, ensuring a seamless user experience. The front-end developer is responsible for creating the user interface, while the back-end developer is responsible for creating the server-side of the app. The quality assurance engineer ensures that the app is bug-free and meets the highest standards of quality. Finally, the security consultant ensures that the app is secure and protected against any potential threats.

Establishing a Project Timeline and Budget

Establishing a project timeline and budget is essential to ensure that your mobile banking app is delivered on time and within budget. Utilize agile development methodologies, set milestones, and allocate enough resources to ensure that your app development process runs smoothly. It is also crucial to have contingency plans in place in case of any unforeseen circumstances that may arise during the development process.

Overall, assembling the right development team is critical to the success of your mobile banking app. By carefully selecting the right team members, establishing a project timeline and budget, and utilizing agile development methodologies, you can ensure that your app is developed to the highest standards and meets the needs and expectations of your customers.

Developing the Mobile Bank App

After assembling your development team and defining the scope and budget of your mobile banking app, it's time to get into the nitty-gritty of the development process. From the right technology stack to agile development methodologies, there's much to consider.

Choosing the Right Technology Stack

The right technology stack for your mobile banking app depends on various factors such as the platform you want to target, performance, security, and scalability. At Artkai, we have a team of experienced developers who utilize the latest technologies to develop mobile banking apps that meet your specific needs.

React Native is a popular choice for developing mobile apps as it allows for cross-platform development, which means that the app can be developed once and deployed on both iOS and Android platforms. Node.js is another technology that we use to develop server-side applications, which can help to enhance the performance and scalability of your app. Additionally, we use Amazon Web Services (AWS) to ensure that your app is secure and reliable.

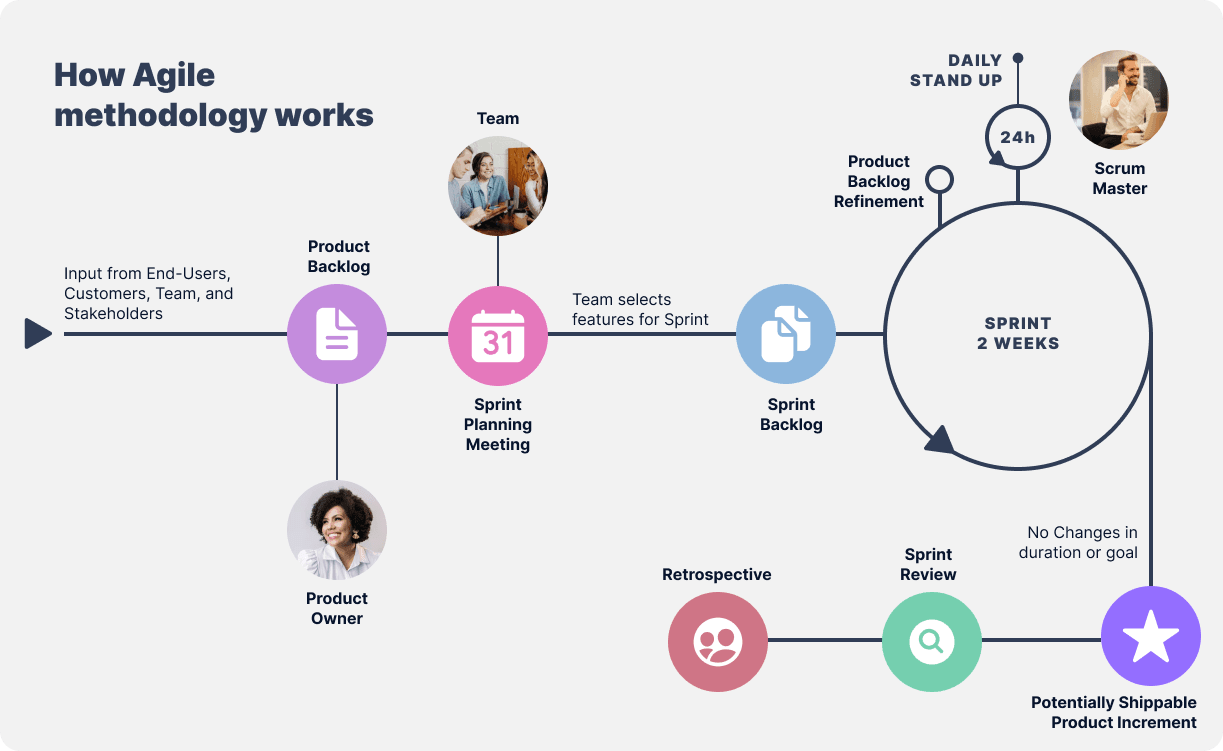

Implementing Agile Development Methodologies

Agile development methodologies such as Scrum and Kanban can help streamline the development process and ensure that your mobile banking app meets your customers' needs and expectations. These methodologies promote rapid iteration, testing, and customer feedback, which can help to ensure that your app is developed quickly and efficiently.

At Artkai, we believe in a collaborative approach to development, which means that we work closely with our clients to ensure that their vision for the app is realized. We utilize agile development methodologies to ensure that the app is developed in a way that meets the client's needs and expectations.

Ensuring Quality Assurance and Testing

Ensuring quality assurance and testing is an integral part of developing a mobile banking app. From functionality to security, your app must meet rigorous standards before it can be launched. At Artkai, we utilize an extensive range of testing tools and methodologies to ensure that your mobile banking app is reliable, secure, and fast.

We conduct both manual and automated testing to ensure that your app is functioning as intended. We also conduct security testing to ensure that your app is secure and protected against potential threats. Additionally, we conduct performance testing to ensure that your app is fast and responsive, even under heavy usage.

In conclusion, developing a mobile banking app requires careful consideration of various factors, from the technology stack to the development methodologies and testing. At Artkai, we have the expertise and experience to develop mobile banking apps that meet your specific needs and exceed your expectations.

Launching and Marketing Your Mobile Bank App

Launching and marketing your mobile bank app is the next step once the development process is complete. From App Store Optimization (ASO) to promotional strategies and channels, much needs to be considered.

App Store Optimization (ASO)

App Store Optimization (ASO) is the process of optimizing your mobile banking app's visibility and ranking in app stores such as Google Play and App Store. It involves keyword research, a compelling description, and high-quality app screenshots.

Promotional Strategies and Channels

Promotional strategies and channels are essential to ensure that your mobile banking app reaches your target audience. From social media to email campaigns, utilize every available channel to promote your app effectively.

Measuring Success and Key Performance Indicators (KPIs)

Measuring success and key performance indicators (KPIs) such as downloads, user engagement, and customer satisfaction are essential to determine the success of your mobile banking app. Use analytics tools such as Google Analytics to track these metrics.

Post-Launch Support and Maintenance

Once your mobile banking app is launched, the work does not stop there. Post-launch support and maintenance are critical to ensure that your app stays up-to-date and meets your customers' expectations.

Regular Updates and Feature Enhancements

Regular updates and feature enhancements are essential to keep your mobile banking app relevant and competitive. From bug fixes to new features, stay ahead of the curve by providing your customers with a seamless and enjoyable user experience.

User Feedback and Continuous Improvement

User feedback and continuous improvement are crucial to creating a mobile banking app that meets your customers' needs. Listen to their feedback, track their behavior, and use this information to improve your app's functionality, security, and user experience.

Scaling Your Mobile Bank App for Growth

Scaling your mobile banking app for growth involves adding new features, expanding into new markets, and improving the app's performance and functionality. We at Artkai utilize cloud-based technologies such as AWS to ensure that your mobile banking app can handle heavy traffic and scale as your business grows.

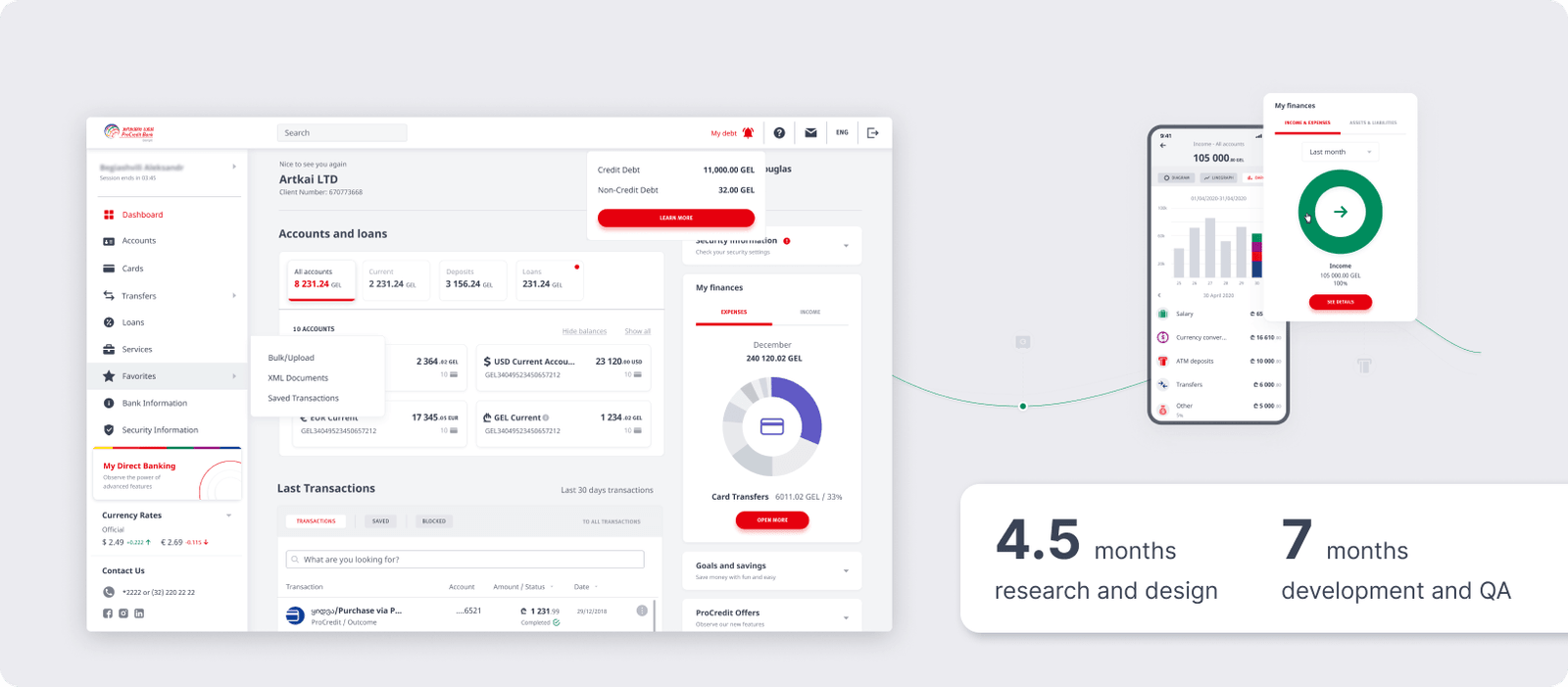

Pro Credit - banking app that Artkai built

Our client wanted to digitalize ProCredit bank entirely. Creating an app ought to have reduced the workload on personnel at physical branches and contact centers and highlighted ProCredit’s financial consulting offerings. The goal was to make existing capabilities more approachable and user-friendly by enabling bank customers to register for and use new services online.

Our team conducted a wide range of research projects, including multiple talks with ProCredit’s IT department and interviews with both bank clients and employees. We segmented the design effort into its component sections with distinct milestones for progression, which made the client’s implementation easier. Artkai revamped the mobile banking app and created web banking with a dashboard and quick access navigation.

Our efforts had notable outcomes for the client:

- Online access to banking services has reached 99 percent.

- Transferring money online or through a mobile banking app takes only half as long.

- Via a mobile banking app, banning a card now happens 60% faster.

- The mobile app logs events twice as quickly as the previous version.

Wrapping up

At Artkai, we have years of experience crafting successful mobile banking apps that meet the needs and expectations of our clients' customers. Contact us today to learn more about how we can help you create a mobile banking app that stands out from the crowd.

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.