March 06, 2023

Custom Mortgage Software Development Guide

As technology advances, it becomes increasingly clear that efficient and digitally-driven operations are crucial for businesses to succeed. The mortgage industry is no different. With custom mortgage software, lenders can streamline their operations, enhance user experience, and boost their success.

Read this post to discover our tips, strategies and take a look at great software examples.

Understanding Custom Mortgage Software

Custom mortgage software is a digital solution designed to automate and streamline the lending process. Through various features, such as loan pre-qualification, documentation management, and payment processing, custom mortgage software improves the overall loan origination process, assists with compliance, and reduces operational costs.

The mortgage lending industry is a complex and highly regulated industry. The process of getting a mortgage can be a daunting task for borrowers, and it can be equally challenging for lenders to manage the process efficiently while ensuring compliance with regulations. This is where custom mortgage software comes in.

Custom mortgage software is designed to simplify the mortgage lending process for both borrowers and lenders. It provides a digital platform that automates many of the manual processes associated with mortgage lending, reducing human error and increasing efficiency.

Benefits of Custom Mortgage Software

From our experience, some benefits of custom mortgage software include:

- Increased efficiency: Custom mortgage software automates manual processes, reducing human error and increasing efficiency.

- Improved accuracy: Custom software solutions can verify data across multiple systems, resulting in more accurate information and faster processing times.

- Enhanced user experience: Providing borrowers with an easy-to-use digital platform from start to finish can improve their experience, leading to more positive feedback and higher customer satisfaction rates.

- Reduced costs: By streamlining processes and reducing the need for manual labor, organizations can save costs and increase profits.

Custom mortgage software offers a range of benefits for lenders and borrowers alike. By automating many of the manual processes associated with mortgage lending, custom software can help to reduce operational costs, improve accuracy, and enhance the overall user experience.

Key Features to Consider

When developing custom mortgage software, there are several key features to consider:

- Loan pre-qualification: This feature allows potential borrowers to determine if they meet the lender's qualification standards.

- Documentation management: Custom software can assist with document collection, organization, and verification, automating the process.

- Payment processing: The ability to process payments digitally and in real-time is critical to a successful digital mortgage lending platform.

- Compliance: Ensuring compliance with regulators' standards and conducting risk assessments can be a vital part of successful custom software development projects.

Each of these features is critical to the success of custom mortgage software. Loan pre-qualification enables potential borrowers to determine if they meet the lender's qualification standards, streamlining the application process. Documentation management helps to automate the collection, organization, and verification of documents, reducing the need for manual labor and increasing accuracy. Payment processing is essential for a successful digital mortgage lending platform, enabling borrowers to make payments digitally and in real-time. Compliance with regulatory standards is also critical, as failure to comply can result in significant legal and financial consequences.

Overall, custom mortgage software is a powerful tool that can help lenders to streamline their operations, reduce costs, and improve the overall user experience. By automating many of the manual processes associated with mortgage lending, custom software can help to ensure compliance with regulatory standards, increase accuracy, and improve efficiency.

Planning Your Custom Mortgage Software Development

Developing custom mortgage software requires a well-planned strategy to ensure that the final product meets your business needs while remaining within budget. Here are some critical steps to consider:

Identifying Your Business Requirements

The first step in the custom software development journey is identifying your unique business needs. This involves taking a deep dive into your company's workflows, requirements, and day-to-day operations. By doing so, you can better understand the challenges your business faces and identify areas where custom software can help streamline processes and improve efficiency.

For example, you may find that your current mortgage software is lacking in certain areas, such as automation or data analysis. By identifying these gaps, you can work with your development team to create a custom software solution that addresses these specific needs.

Setting Your Budget and Timeline

Setting your budget and timeline early on is crucial for project success. Custom software development can be expensive, so having a clear understanding of your budget can help you stay within your financial limitations while still delivering a quality product. It's important to consider not just the initial development costs, but also ongoing maintenance and support expenses.

Determining a realistic timeline is also crucial, as it can impact when you can expect to see a return on investment. Your development team can help you create a timeline that takes into account all aspects of the project, from initial planning to final delivery.

Choosing the Right Development Team

To develop quality custom mortgage software, you need an experienced development team with a proven track record. A development team with relevant industry experience can deliver a custom mortgage platform that aligns with your specific needs and helps you achieve your business objectives.

When choosing a development team, it's important to consider factors such as their technical expertise, project management skills, and communication abilities. Look for a team that has experience working on similar projects and can provide references or case studies to demonstrate their capabilities.

Overall, developing custom mortgage software requires careful planning and execution. By following these critical steps, you can ensure that your custom software solution meets your business needs while remaining within budget and timeline constraints.

Mortgage Software Development Process

Developing custom mortgage software is a complex process that requires careful planning and execution. A well-designed and implemented software solution can streamline mortgage processing, improve accuracy, and reduce manual errors. The mortgage software development process comprises several stages, including:

Planning and Requirements Gathering

The planning stage involves defining project objectives, identifying stakeholders, and gathering requirements. This step is crucial as it lays the foundation for the entire project. The development team should work closely with the client to understand their needs and expectations. The team should also analyze the existing mortgage processing system and identify areas that need improvement.

Design and User Experience

Custom mortgage software should be designed with the end-user in mind, with a focus on creating an intuitive and straightforward user experience. Through user research and design processes, the development team can evaluate and refine the software's user experience. The team should also consider the branding and visual design of the software to ensure it aligns with the client's brand identity.

Core Functionality Development

The core functionality of custom mortgage software is critical and should be developed with a focus on speed, reliability, and scalability. This step involves developing all necessary features to ensure the software performs as intended. The development team should also prioritize security and data privacy to protect sensitive information.

Integration with Existing Systems

Custom mortgage software needs to integrate seamlessly with existing systems to ensure a smooth transition from manual processes to automation. Integration also ensures that data flows correctly through various systems, minimizing risks of errors and duplication of work. The development team should work closely with the client's IT department to ensure a seamless integration process.

Testing and Quality Assurance

To ensure proper functionality, bug-free software, and compliance, rigorous testing and quality assurance processes should be performed. These processes test the software for accuracy, efficiency, and potential issues in real-world use cases. The development team should also conduct user acceptance testing to ensure the software meets the client's requirements and expectations.

Overall, the mortgage software development process is complex and requires a dedicated team of professionals with expertise in software development, user experience design, and project management. A well-designed and implemented mortgage software solution can revolutionize the way mortgage processing is done, resulting in increased efficiency, accuracy, and customer satisfaction.

Deployment and Maintenance

After development and testing, it's time to launch your custom mortgage software. This involves an end-to-end implementation process, which includes training for your team and configuring software settings to optimize its functionality.

Launching Your Custom Mortgage Software

The launch of your custom mortgage software is a significant milestone in your business. It marks the culmination of months of hard work and dedication by your development team, and it's time to reap the benefits of your investment.

Before launching your software, it's essential to ensure that it's ready for prime time. This means that all testing and quality assurance processes have been completed, and all bugs have been fixed. Once you're confident that your software is ready, it's time to launch.

Launching your software involves a series of steps, including configuring your software settings, setting up user accounts, and migrating data from your legacy systems. It's essential to have a detailed plan in place to ensure that the launch goes smoothly.

Training Your Team

While custom software is built to streamline workflows and improve efficiency, it requires proper training to operate optimally. Team training should cover all aspects of the software including setup, usage, and maintenance in case any issues arise.

Training your team is a crucial step in the deployment process. It ensures that your team is equipped with the knowledge and skills they need to use the software effectively. It's essential to provide comprehensive training to all team members, from executives to front-line staff.

Training should be ongoing, with regular refreshers and updates to ensure that your team is up-to-date on the latest features and functionality of the software.

Ongoing Support and Updates

Custom mortgage software should be continually maintained and updated with industry regulations and best practices. This includes software updates, bug fixes, and ensuring data privacy. By optimizing its performance, custom software can continue to drive business success for years to come.

Providing ongoing support and updates is essential to ensure that your software remains secure and up-to-date. This includes monitoring for bugs and vulnerabilities, providing regular software updates, and ensuring that your software complies with industry regulations.

By providing ongoing support and updates, you can ensure that your software remains relevant and effective, driving business success for years to come.

Regulatory Compliance and Security

With data privacy concerns at an all-time high, security and compliance are essential components of any custom mortgage software project. From our experience, we highly recommend:

Ensuring Data Privacy

Custom mortgage software should have the appropriate security measures in place to maintain data privacy. It should be able to handle sensitive data securely, interact with systems that require secure authentication, and provide encrypted communications between the borrower and lender.

One way to ensure data privacy is to use encryption. Encryption is a process of converting data into a code to prevent unauthorized access. By using encryption, sensitive data such as social security numbers and financial information can be protected from hackers and cybercriminals.

Another way to ensure data privacy is to limit access to sensitive data. Access should only be granted to authorized personnel who have a legitimate need to access the data. This can be achieved by implementing role-based access control, which allows access to be granted based on a user's role within the organization.

Meeting Industry Regulations

Court compliance is an essential aspect of mortgage lending. Therefore, custom software should be built to adhere to industry regulations and standards. Best practices include adherence to industry standards like GDPR, AML, and other regulatory frameworks.

The General Data Protection Regulation (GDPR) is a set of regulations that govern the collection, use, and storage of personal data for individuals within the European Union. Anti-Money Laundering (AML) regulations are designed to prevent money laundering and terrorist financing. Compliance with these regulations is essential to avoid legal and financial penalties.

Implementing Security Best Practices

Security should be paramount when building custom mortgage software. Security best practices should be incorporated into the development process and should include proper monitoring of user access, a plan for how to handle incidents, and use of multi-factor authentication for system access.

One security best practice is to implement intrusion detection and prevention systems (IDPS). IDPS can detect and prevent unauthorized access to the system by monitoring network traffic and identifying suspicious activity. Another best practice is to conduct regular security audits to identify vulnerabilities and address them before they can be exploited.

Multi-factor authentication is another important security measure. Multi-factor authentication requires users to provide two or more forms of identification before accessing the system. This can include something the user knows, such as a password, something the user has, such as a smart card or token, or something the user is, such as a fingerprint or facial recognition.

Evaluating the Success of Your Custom Mortgage Software

Once your custom mortgage software is in place, it's essential to continually evaluate its performance and usability. Your software's success is dependent on how well it performs and how satisfied your users are with its functionality. Here are some ways you can evaluate the success of your custom mortgage software:

Key Performance Indicators

One of the most important metrics to monitor is your custom software's key performance indicators. These metrics include the amount of time it takes to process loans, the number of loan applications received, and the time taken to process requests. By monitoring these KPIs, you can identify any obstacles prohibiting growth and determine how to proceed. For example, if you notice that it takes too long to process loan applications, you may need to optimize your software to speed up the process.

User Feedback and Satisfaction

User feedback is a crucial component of software development, as it helps you identify bottlenecks and make improvements. By regularly surveying borrowers and lenders and capturing feedback, you can optimize your custom software to enhance its functionality and usability further. You can also use user feedback to identify any pain points or issues that users may be experiencing, so you can address them promptly. By consistently improving your software based on user feedback, you can ensure that your users are satisfied and that your software is meeting their needs.

Continuous Improvement and Future Development

With custom mortgage software, continuous improvement is essential. With the help of user feedback, you can identify what works and what doesn't, and continuously improve upon your software to maximize productivity and profitability. You can also use user feedback to inform future development plans and ensure that your software remains relevant and useful in the long term. By staying up-to-date with the latest technological advancements and industry trends, you can ensure that your software is always ahead of the curve.

Overall, evaluating the success of your custom mortgage software is an ongoing process that requires constant attention and improvement. By monitoring key performance indicators, capturing user feedback, and continuously improving your software, you can ensure that it remains relevant, useful, and profitable for years to come.

Why Choose Artkai for Custom Mortgage Software Development

Are you in the mortgage lending sector and looking for a custom software solution? Look no further than Artkai! With years of proven experience in developing digital products, we are a customer-centric agency that can help bring your vision to life.

Our expertise in developing custom software for various industries, including the mortgage lending sector, is well-established. We understand the unique needs of this industry and can help you create a software solution that is tailored to your specific needs.

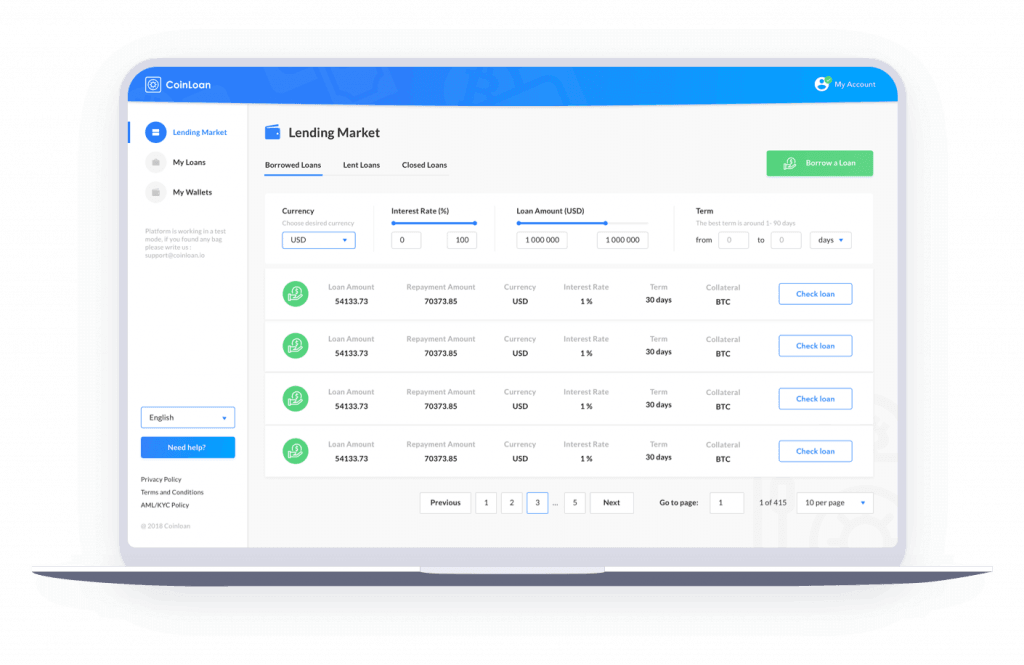

CoinLoan – A Web-based P2P Lending Platform

Platform: Web

About

CoinLoan is the first crypto-to-fiat lending platform for digital assets-backed loans with marketplace opportunities. Its primary purpose is to allow crypto holders to get fiat money without selling their digital assets.

Objectives

Our client’s key goal was to create a readily available, informative, and intuitive lending platform with a P2P ecosystem, custom UX & UI design, and easy user flows for funds withdrawal via transfer as a competitive advantage.

Outcomes

Together with the client, Artkai introduced a custom UX & UI design that featured a highly accessible, secure, and intuitive website and a landing platform with the P2P economy. As a direct result of our collaboration, the CoinLoan.io platform has gained more than 100k active users.

To see the solutions we came up with, check out the full CoinLoan case study.

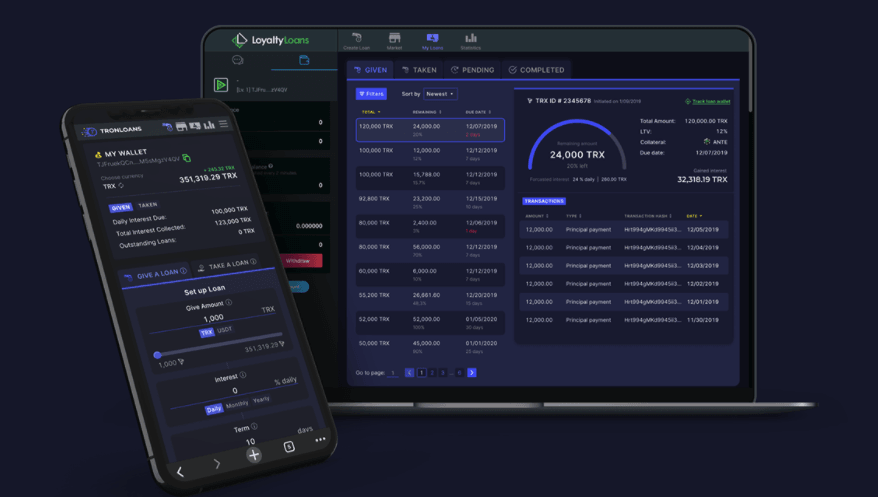

Loyalty loans – P2P loan platform

Platform: Web

About

LoyaltyLoans is a loan platform that allows dApp tokens to be used as collateral.

Outcomes

We created a web platform with an excellent UX/UI that communicates the main idea and the functionality that makes the process of lending and borrowing clear and straightforward. The platform we designed can be swiftly integrated into any dApp frame size and includes an easy-to-set-up API.

Some of our recent projects include:

To Conclude

If you're looking for a reliable technology partner for your custom mortgage software development needs, contact Artkai today. Our team of experienced developers is ready to help bring your vision to life.

At Artkai, we understand that every project is unique, and we work closely with our clients to ensure that we deliver a software solution that meets their specific needs. Whether you need a simple mortgage calculator or a more complex software solution, we can help.

Contact us today to learn more about our custom mortgage software development services and how we can help you achieve your business goals.

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.