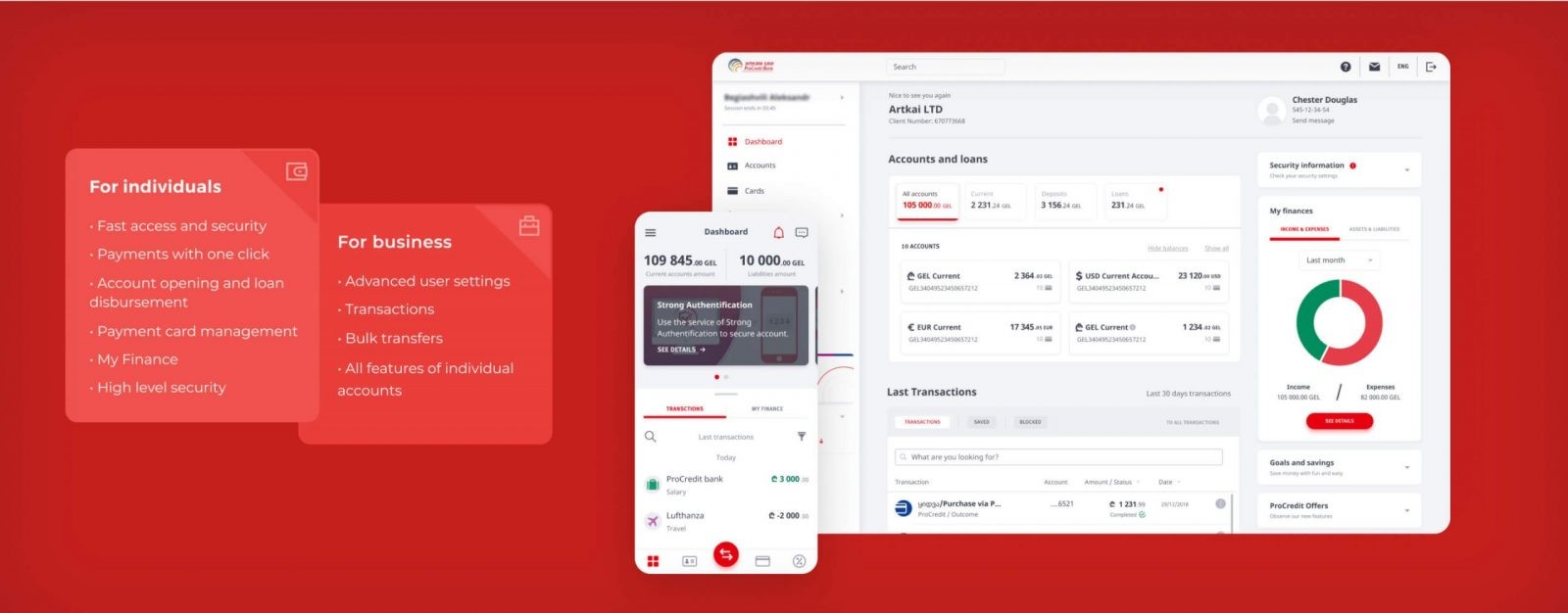

Online banking app for ProCredit

Web and mobile online banking.

OVERVIEW

About the business

The ProCredit Group is made up of development-oriented commercial banks operating in South Eastern and Eastern Europe and South America, as well as a bank in Germany. Based in Frankfurt, Germany, the parent company of the group, ProCredit Holding, is responsible for the strategic management, capital adequacy, reporting, risk management, and proper business organisation of the group.

ProCredit Bank, Georgia has been operating in the Georgian banking sector since 1999. The basic purpose of the bank’s activities is to finance small and medium-sized businesses that have a long-term development plan. ProCredit Bank also promotes a savings culture among the general population.

OVERVIEW

Project tasks

- Make ProCredit entirely digital, create an app to reduce the workload on physical branches, contact center staff, and increase the ProCredit focus on financial consultancy and advising.

- Provide bank clients an opportunity to access and register new services online

- Convert all existing features into more accessible and easy-to-use tools

OVERVIEW

Project team

Team: 2 UI/UX designers, 3 Front-end engineers, Project manager, Business analyst, QA engineer.

4.5

months for research and design

7

months for development and QA

Design and development are done in parallel after the research and discovery phase.

OVERVIEW

Tech stack

TypeScript

React.js

Redux

React Native

Next.js

Microsoft Azure

MSSQL

REST

Swagger

Socket.io

GraphQL

Get a quote

or free consultation

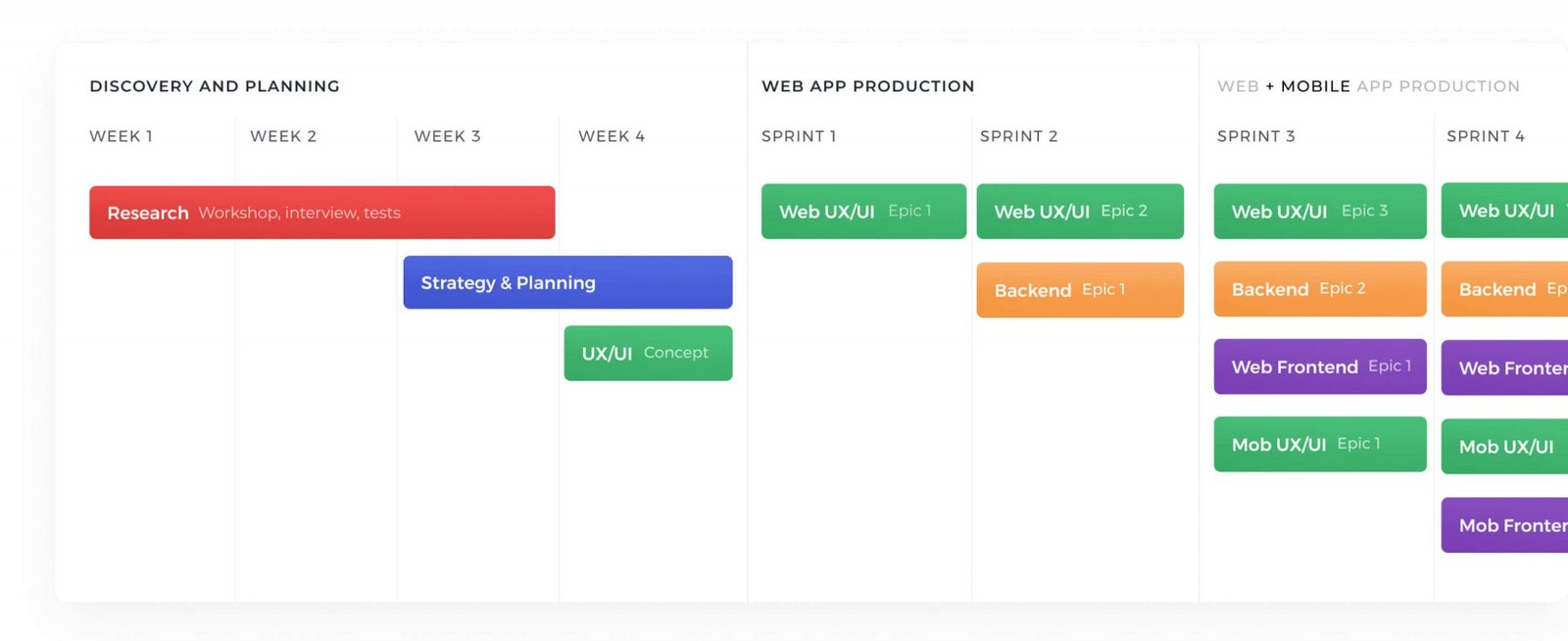

PROJECT JOURNEY

Product development

ProCredit. Work plan.

Research phase & Product discovery

Together with the ProCredit team, we set up a process for all project stages in a way that minimized and eliminated downtimes. Thus, API delivery and front-end development of a new module were not started before the design for this section was delivered.

2 day onsite workshop

We interviewed ProCredit employees and gained a full understanding of their goals and priorities from both the online and offline perspective.

21 in-depth interviews

We conducted in-depth interviews with ProCredit clients to understand their workflow, priorities, decision-making processes, and pain points.

9 usability tests

• Getting a loan

• Creating a loan

• Tracking the progress of my loan

Project goals based on research and interviews results

1

Flexibility and personalization

Users have a wide range of requirements and habits. The new tool needed to allow users to set the interface according to their needs.

2

Control

Most users would like to have more control over their finances. It was essential to consider how the tool would best help users get this control.

3

Consistency

Many customers use mobile and web versions, so we had to ensure that the user experience was consistent. We wanted users to switch between devices without getting disoriented.

4

Relevant support

Make sure we give users all requested information at on each step of the flow. We wanted a good balance that provided everything needed while not overloading the user.

5

Security

ProCredit maintains high standards for security, so the new experience should build on this reputation and support security innovations.

6

Awareness

Keep users updated about new features and services offered by ProCredit. Users should always know how to solve problems via online banking.

PROJECT JOURNEY

Web banking

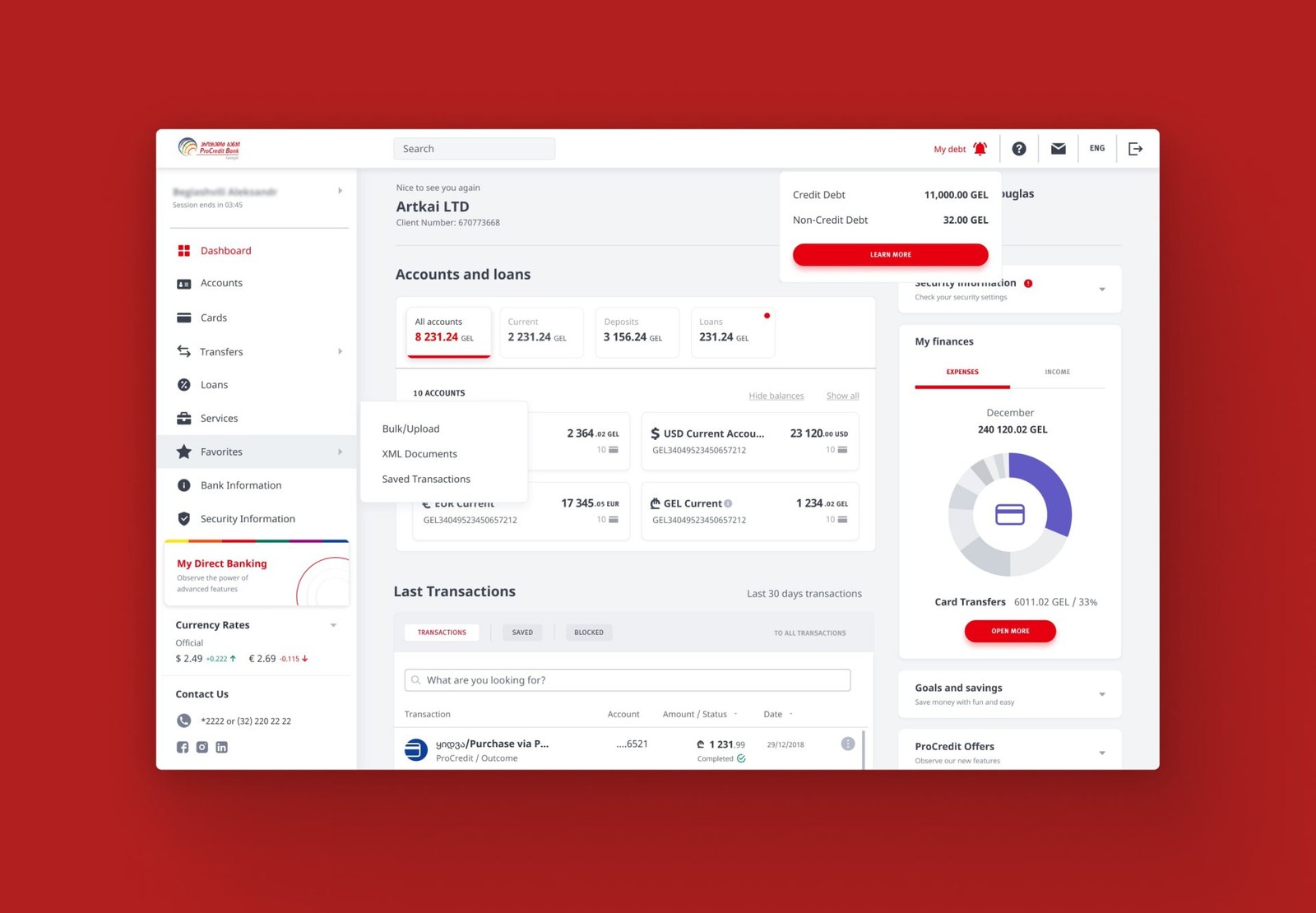

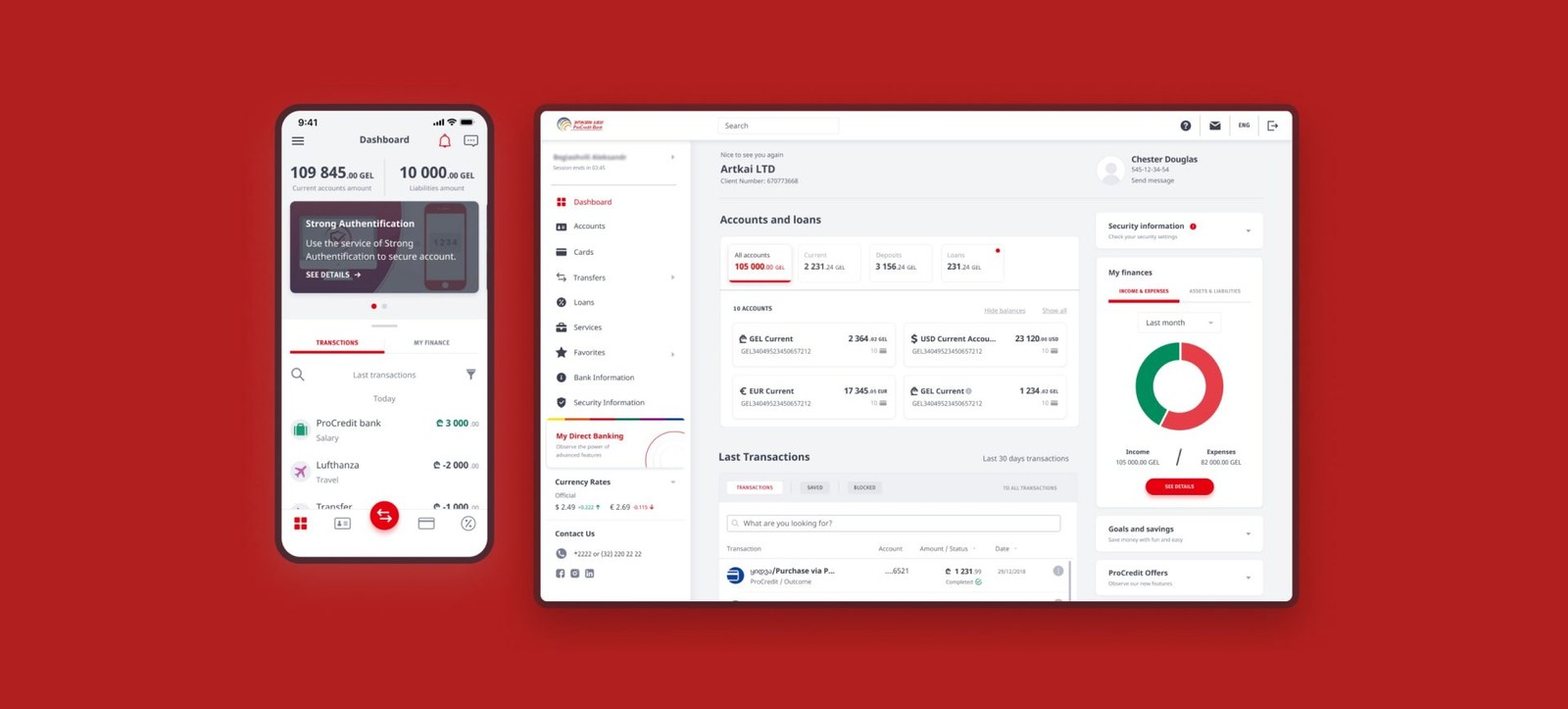

The Dashboard

All main actions are now on one screen, with full access to special topics with personalized navigation. Users can review and manage their accounts. As most users use a wide range of features on an everyday basis we needed to consolidate all data on one screen to give users an overview on one page.

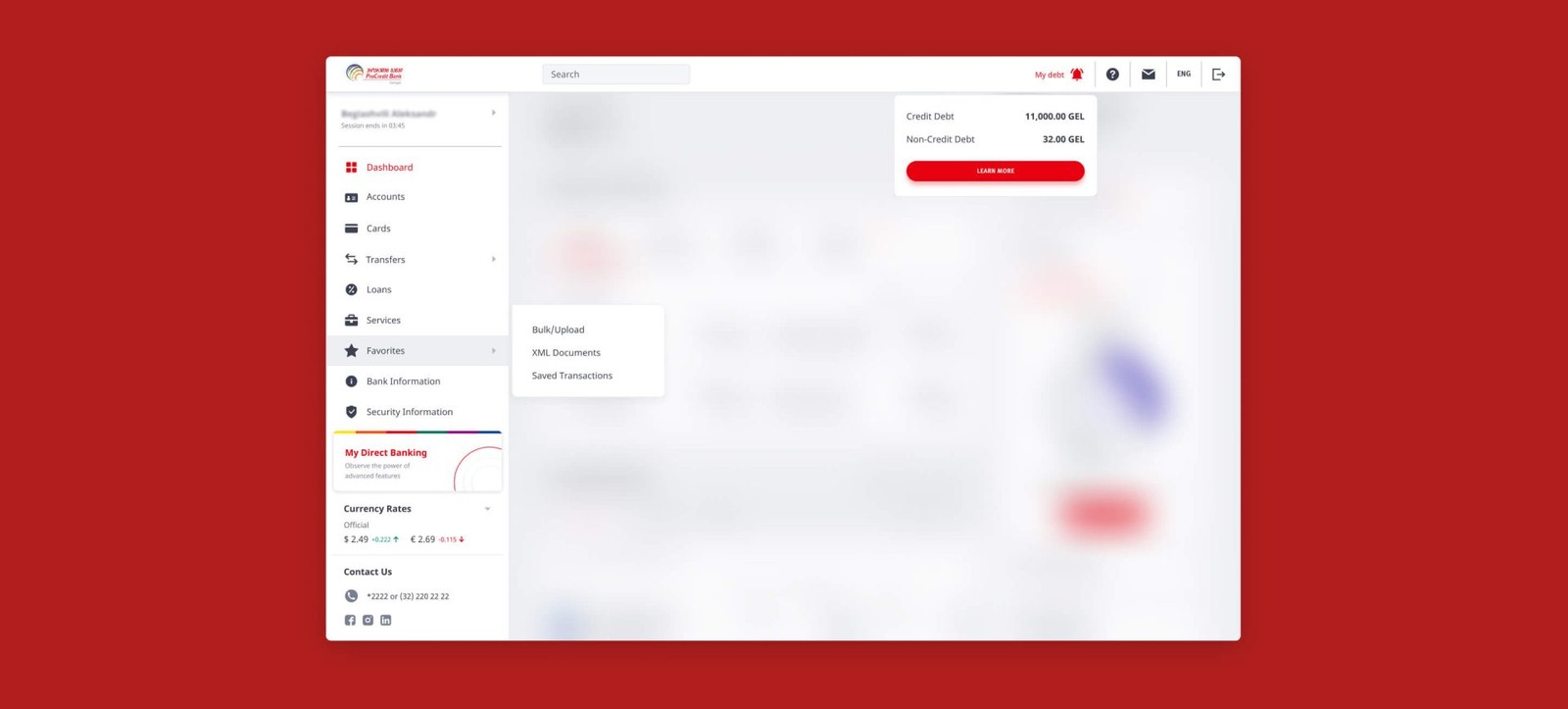

ProCredit. Favorites.

Fast access navigation

We developed fast access navigation that highlights key banking elements based on previous user habits for a predictable experience. Also, users may now customize their menu using a Favourites section.

ProCredit. Fast access.

PROJECT JOURNEY

Mobile banking app

We integrated the process of bank account registration with Video Identification tools. Clients can now complete the onboarding process and open a bank account without a single visit to the bank branch.

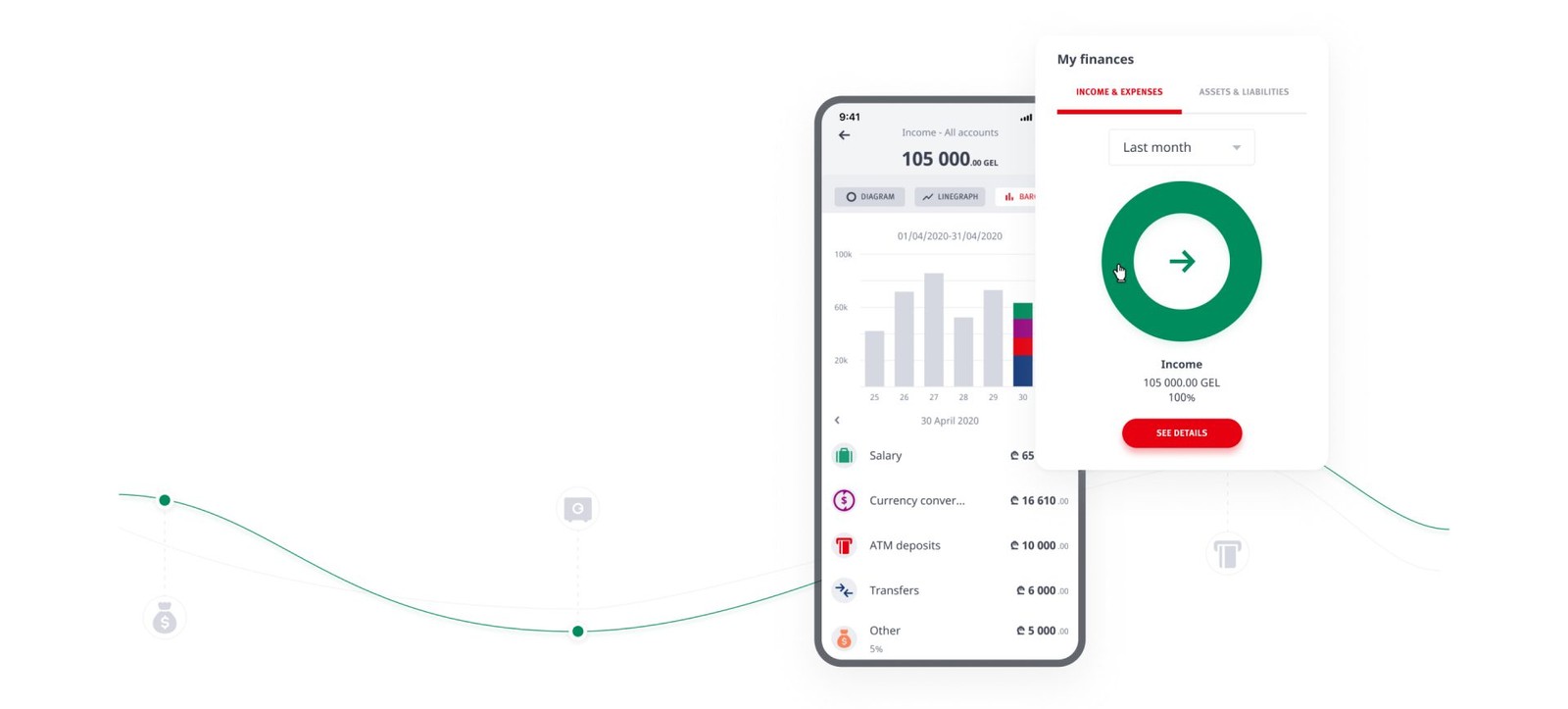

My finances section

The Artkai production team designed and developed the “My finance” feature from scratch. Now ProCredit clients can track their expense and income transactions, and view statistical data in different graphic forms on both the web and the mobile app.

ProCredit. My finances.

Onboarding

We integrated the process of bank account registration with Video Identification tools. Clients can now complete the onboarding process and open a bank account without a single visit to the bank branch.

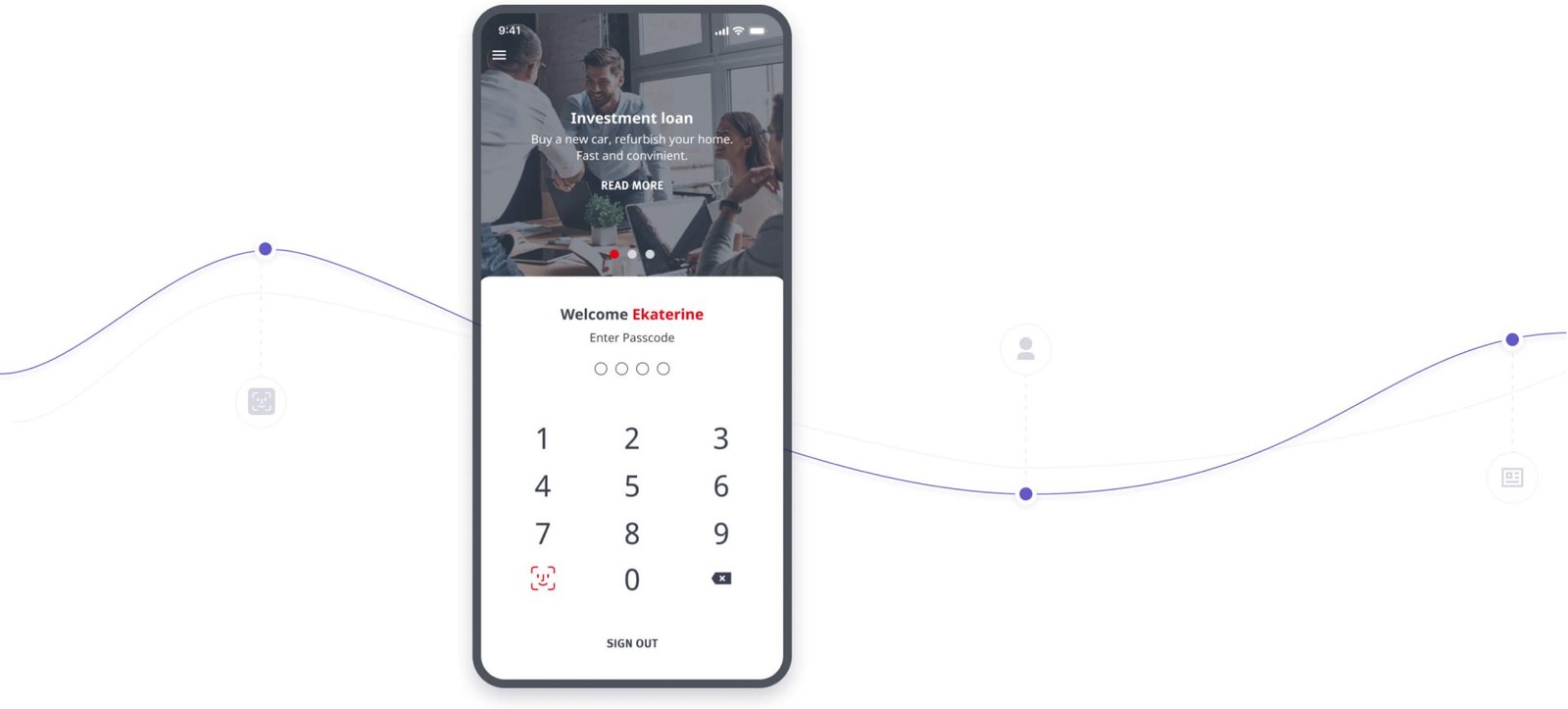

Smart Login

Mobile app and Web online banking now have an integrated ecosystem of banking products. Artkai achieved this by creating a new GUI system for both platforms and using React & React Native on the Front side.

ProCredit. Smart login.

Previously the log-in page was represented by “Username” and “Password”. To make the process easier yet secure, we developed the functionality of adding a passcode with four digits or Touch/Face ID depending on the operating system – iOS or Android and the possibility of a smartphone.

RESULTS

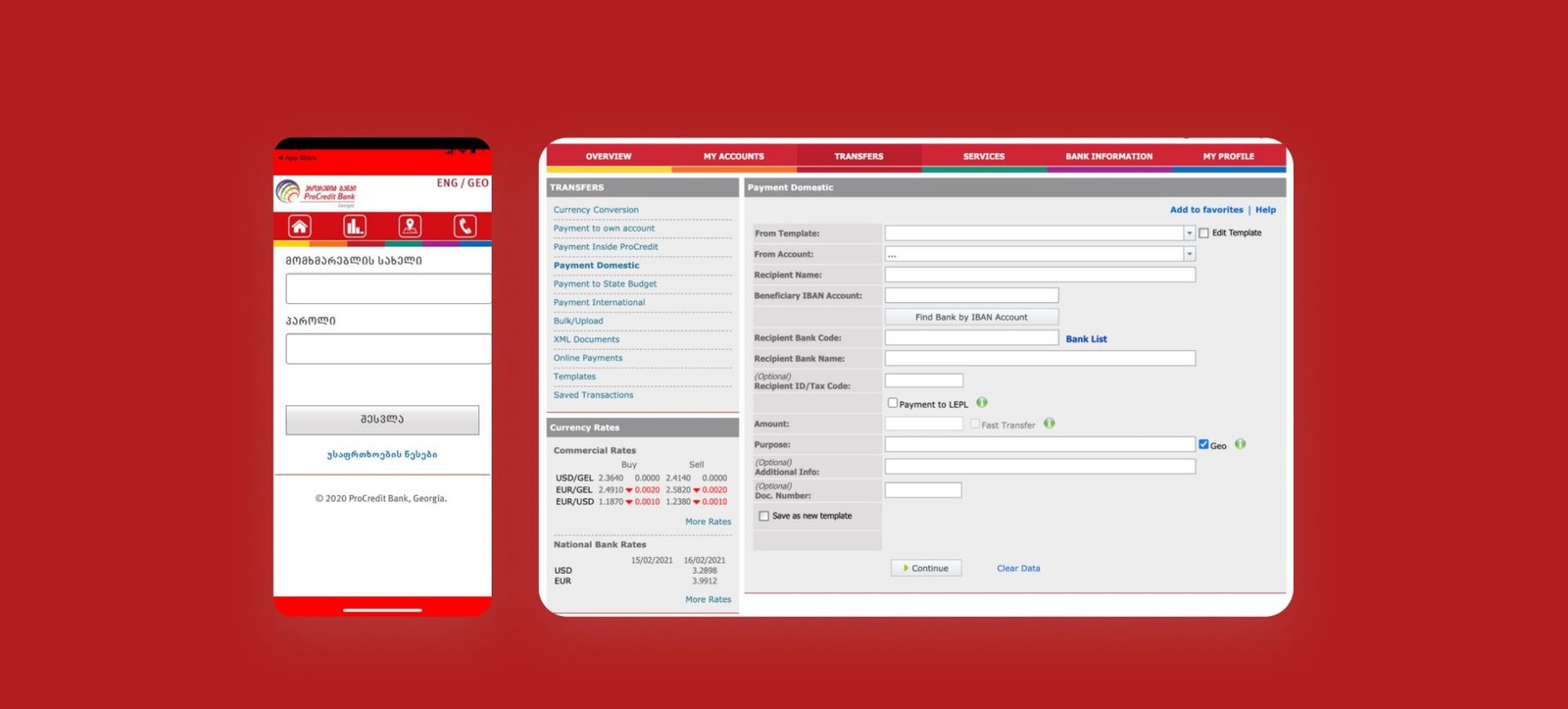

Before / After

ProCredit. Before we start working.

ProCredit. Our redesign.

OUTCOME

Outcome

99%

of eligible banking services are performed online

x1,5

reduced time to make a transfer through the web online and mobile banking app.

60%+

faster speed of blocking a card via mobile banking app

x2

the mobile app gets faster to log in comparing with the previous version

REVIEWS

Client review

Read More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.