June 30, 2023

Personal Finance App Development Guide

Managing personal finances effectively is crucial for a better future and a stress-free life. Nowadays, many people are looking for mobile apps to help them manage their finances on the go. As a customer-centric digital product development agency with a proven track record, we at Artkai have extensive experience in designing and developing mobile apps that can help individuals and businesses manage their personal finances efficiently.

Here is our comprehensive guide to help you develop your own personal finance app and make it successful:

Understanding the Personal Finance App Market

Before developing a personal finance app, it is essential to research and analyze the market. You need to know the current market trends, key players, and target audience. From our experience, we have found that the personal finance app market is quite competitive and innovative, with established companies like Mint and Personal Capital dominating the market.

However, the personal finance app market is not limited to these two companies. There are many other key players in the market that you should be aware of. These players offer different features and functionalities, which you can analyze and incorporate into your app.

Key Players in the Market

When analyzing the personal finance app market, you can look closely at the following three key players:

- Aggregators: These apps sync all an individual’s financial data into one place. Generally, these come with a marketing assurance of enhanced security but lack the many features for in-depth financial planning and analysis.

- Robo-Advisors: These apps provide investment management services using algorithms to maximize ROI. Users customize investment goals, strategies, risk level, and more, and automated investing and rebalancing do the rest.

- Full-Service Platforms: These apps offer in-depth financial analysis and management, including budgeting, credit score tracking, investment management, and other analysis tools.

Each of these key players has its unique features and functionalities that cater to different user needs. For example, aggregators are great for individuals who want to keep track of their finances in one place, while full-service platforms are ideal for those who require more in-depth financial analysis and management.

Target Audience and User Needs

Knowing your target audience and their needs is essential in developing a successful personal finance app. From our experience, we have found that the target audience includes individuals, families, and businesses. They require an app that can manage their finances, help with savings, aid in investment management, and provide a debt-reduction strategy. A user-friendly interface that offers customized budgeting tools, investments management, and asset allocation analysis is a must-have for the app.

It is also important to note that different target audiences have different needs. For example, families may require more budgeting tools, while businesses may require more investment management features.

Market Trends and Opportunities

As the market is continually evolving, it is essential to keep up with the latest trends and opportunities. Some of the current trends and opportunities available are:

- Integration with financial institutions: This feature is integral in managing funds and ensuring security. The app can connect to financial institutions to help reduce the need for manual data entry and offer enhanced security.

- Personalization and automation: Automation and personalization features help users track expenses and automate bill payments and investments while offering custom budget alerts.

- Adoption of blockchain technology: Blockchain has become an innovative way in securing transactions and personal data while having a solid recourse.

By keeping up with the latest trends and opportunities, you can stay ahead of the competition and provide your users with the best possible experience. It is essential to analyze the market continuously and incorporate new features and functionalities into your app to keep it relevant and useful to your users.

Defining Your App's Purpose and Features

When it comes to designing an app, it's crucial to define its purpose and features. These defining features are what will determine whether users will adapt to it and continue using it. Therefore, it's essential to focus on the following core features when designing your app:

Budgeting and Expense Tracking

One of the most important features of a financial app is budgeting and expense tracking. The app should offer customized budgeting features that help users monitor their finances, categorize spending, and track expenses. This way, users can get a clear understanding of where their money is going. Additionally, the app should provide insights that help users see real-time visuals of their spending and help them spot their money management weak spots. This feature is critical because it helps users stay on top of their finances and make informed decisions.

Investment Management

Another crucial feature of a financial app is investment management. The app should provide users with tools to research and analyze asset allocation, diversification, and current economic forecasts. This way, users can make informed investment decisions. Additionally, the user should have access to real-time data and analysis to aid investment decision-making. This feature is essential because it helps users grow their wealth and achieve their financial goals.

Debt Management and Reduction

Debt can be a significant source of stress for many people. Therefore, an excellent financial app should offer features to help users track their credit scores and provide personalized advice for loan refinancing, consolidation, and strategies to speed up the debt reduction process. This way, users can get a clear understanding of their debt situation and take steps to reduce it. This feature is critical because it helps users achieve financial freedom and reduce stress.

Financial Goal Setting and Progress Tracking

Customizable planning features are also essential for a financial app. These features help users define and visualize their financial goals for accurate measurement and tracking. This way, users can get a clear understanding of what they want to achieve financially and track their progress towards those goals. This feature is critical because it helps users stay motivated and on track towards achieving their financial goals.

Integration with Financial Institutions

Finally, it's crucial for a financial app to integrate with financial institutions. This critical feature helps the app connect with financial institutions to download real-time data, reconcile spending and improve accuracy in categorizing. This way, users can get a clear understanding of their financial situation and make informed decisions. This feature is essential because it helps users stay on top of their finances and make informed decisions.

Overall, designing a financial app with these core features in mind can help users achieve financial freedom, reduce stress and make informed decisions.

Designing an Intuitive User Interface

Designing an intuitive user interface is essential to the success of any app. An intuitive user interface can make the difference between a successful app and one that users abandon after a few uses. The following principles should guide the design:

User Experience (UX) Principles

When designing an app, it is essential to prioritize user experience. The app should be easy to navigate, with a consistent and clear design and messaging. Key features should be easily accessible and user-friendly. It is also important to integrate device features like biometric security to enhance the user experience.

One way to prioritize user experience is to conduct user testing throughout the design process. User testing can help identify pain points and areas where the design can be improved to enhance the user experience.

Navigation and Menu Layout

The navigation and menu layout of an app are critical to its success. The app should have an easy-to-navigate interface that offers strategic menu layouts, easy-to-understand icons, and a visually appealing interface. The menu layout should be intuitive and easy to use, with clear labels and icons that are easy to understand.

One way to ensure an intuitive navigation and menu layout is to use a design system that includes a set of guidelines and components that can be used to create a consistent and cohesive design throughout the app.

Data Visualization and Reporting

Data visualization and reporting are essential features for any financial app. The app should offer users customizable financial reports with clean and intuitive visualization, including charts and diagrams that are well understandable to end-users. The data should be presented in a way that is easy to understand, with clear labels and descriptions.

One way to enhance data visualization and reporting is to use interactive charts and graphs that allow users to explore the data in different ways. Interactive charts and graphs can help users gain a deeper understanding of their financial data and make more informed decisions.

Customization and Personalization

The app should offer customization features that allow users to edit and manage their account with their details, goals, and preferences, including settings like preferred spending categories and notification alerts. Customization and personalization can help users feel more connected to the app and make it more likely that they will continue to use it.

One way to enhance customization and personalization is to use machine learning algorithms that can analyze user data and make personalized recommendations based on their spending habits and financial goals.

By following these principles, you can design an intuitive user interface that will help ensure the success of your app. Remember to prioritize user experience, create an easy-to-navigate interface, offer customizable financial reports, and provide customization and personalization features to enhance the user experience.

Ensuring Data Security and Privacy

Ensuring data security and privacy is crucial for businesses that process and store sensitive user data. This is especially important in today's digital age where data breaches and cyber attacks are becoming increasingly common. When it comes to developing an app, it is essential to prioritize data security and privacy features to ensure user trust, integrity, and reliability in your app.

Encryption and Secure Data Storage

One of the essential security features that an app should have is end-to-end encryption to secure the data in transit and storage. End-to-end encryption ensures that only the sender and the intended recipient can read the messages, and no one else, including the app developer or service provider, can access the data. Additionally, the app should retain only the necessary data, and where possible, anonymize the sensitive data to minimize the risk of data breaches.

Another critical aspect of secure data storage is the use of secure servers and data centers. The app should use servers that are protected by firewalls, intrusion detection systems, and other security measures to prevent unauthorized access to the data.

User Authentication and Authorization

The app should require strong authentication rules like multi-factor authentication and authorization protocol to minimize the chance of data breaches. Multi-factor authentication is a security process that requires users to provide two or more forms of identification before accessing their accounts. This can include a password, a fingerprint scan, or a facial recognition scan.

Authorization protocols are another essential security feature that an app should have. Authorization protocols are rules that determine who has access to what data. By implementing authorization protocols, developers can ensure that only authorized users can access sensitive data, reducing the risk of data breaches.

Compliance with Data Protection Regulations

It is also essential for the app to be compliant with data protection regulations such as the General Data Protection Regulation (GDPR) and the National Data Protection Authority (DPA). These regulations provide guidelines on how businesses should collect, process, store, and delete user data. By complying with these regulations, app developers can ensure that they are handling user data responsibly and ethically.

Transparency and User Control

Finally, an app should provide users with transparency in data collection, processing, storage, and deletion while granting them control and access to their personal data. This can include providing users with clear and concise privacy policies, giving them the option to opt-out of data collection, and allowing them to delete their data at any time.

Overall, ensuring data security and privacy is a critical aspect of developing an app. By implementing essential security features like encryption, user authentication, and compliance with data protection regulations, app developers can ensure that their app is secure and reliable. Additionally, providing users with transparency and control over their personal data can help build trust and loyalty with users, leading to increased app usage and customer satisfaction.

Developing and Testing Your App

During the development phase, it is essential to choose the right platform for your app. From our experience, Agile development and iterative improvements are essential in ensuring successful app development. You should prioritize the following activities:

Choosing the Right Development Platform

The app development platform should be easily accessible, scalable, flexible, and user-friendly with tools that can integrate into the app's features and functionalities and be robust enough to support the app's future growth.

Agile Development and Iterative Improvements

Agile processes allow for more flexibility during the development process through testing, iteration, and user feedback sessions. Agile processes focus on collaboration, iteration, user feedback, and rapid delivery.

Quality Assurance and Testing Strategies

Quality assurance should include testing for functionality, usability, performance, compatibility, and security. Automated testing tools like Selenium, Jenkins, and Appium are useful for testing, and human testers can provide and validate pre- and post-production tests.

Beta Testing and User Feedback

Release a beta version of your app to early adopters to gather feedback for improving the app's quality and to ensure it resonates with the target audience.

Monetization and Marketing Strategies

Monetization is crucial to offset the development and operational expenses of an app. From our experience, there are several methods to monetize your personal finance app, including:

Freemium Model and In-App Purchases

The freemium model offers users a basic version of the app, with limited features, and encourages them to upgrade to premium for advanced features with in-app purchases.

Subscription-Based Services

Offering premium features like personalized financial consulting for a monthly subscription fee is a reliable revenue-generating strategy.

Advertising and Sponsorships

The app can offer advertising space or sponsorships to external companies and businesses that offer complementary services to its users.

App Store Optimization and User Acquisition

Successful personal finance apps must optimize for app store rankings and promote user acquisition through SEO, social media, targeted advertisements, and referral programs.

Case Studies of Our Successful Client Apps

At Artkai, we have developed several successful mobile apps for clients in the personal finance sector. Below are some examples:

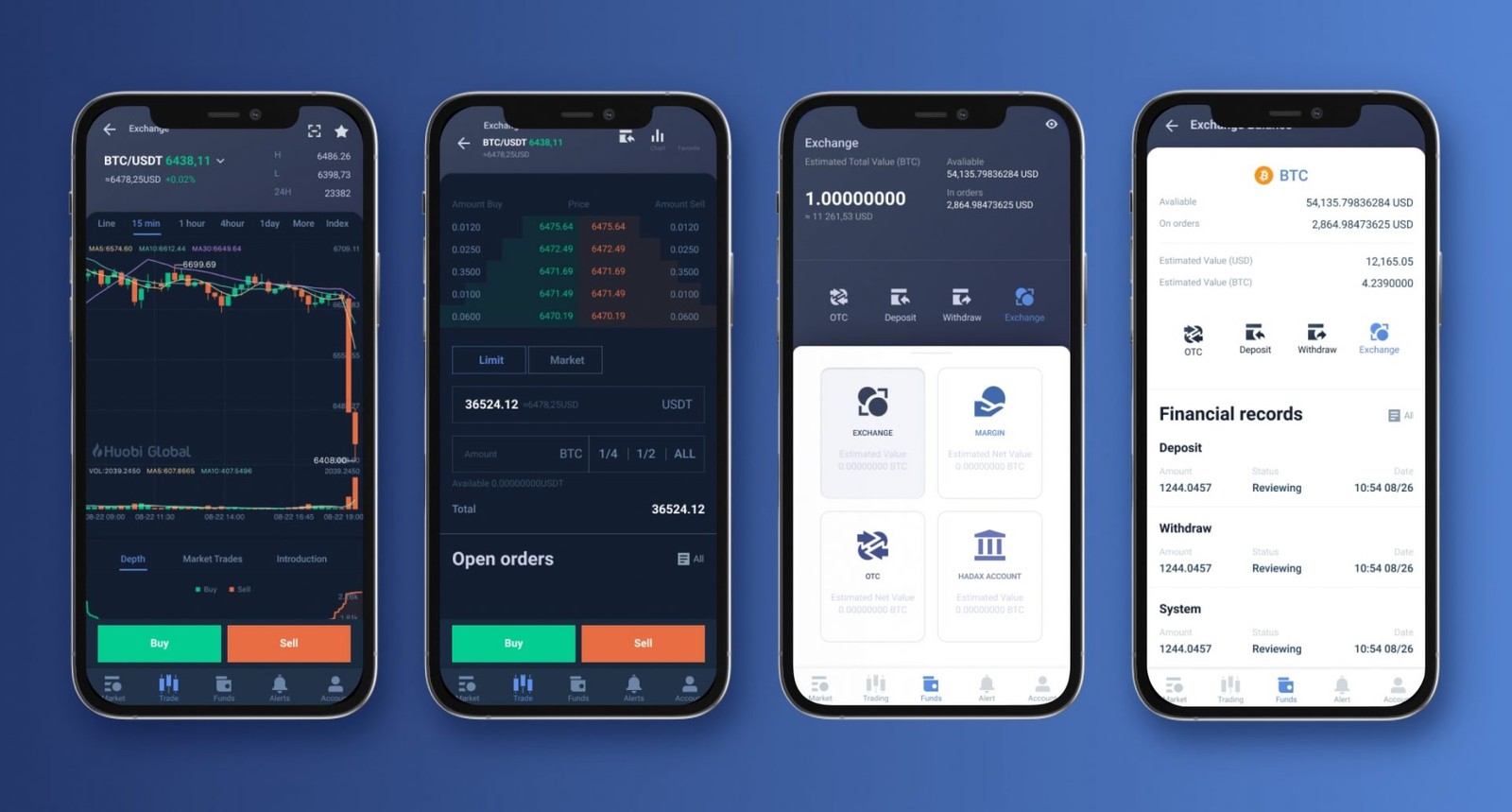

Huobi - Mobile Trading platform

Huobi is one of the largest cryptocurrency exchanges in the world, with millions of users relying on the app daily. We worked with Huobi to develop a mobile trading platform that offered a plethora of useful, user-friendly features, including price tracking of several cryptocurrencies in real-time, AI-powered cryptocurrency market insights, and an easy-to-navigate trading interface.

The app's forte, among other features, is its speed and easy-to-navigate interface, providing a personalized user experience for Huobi's customer base.

Screens

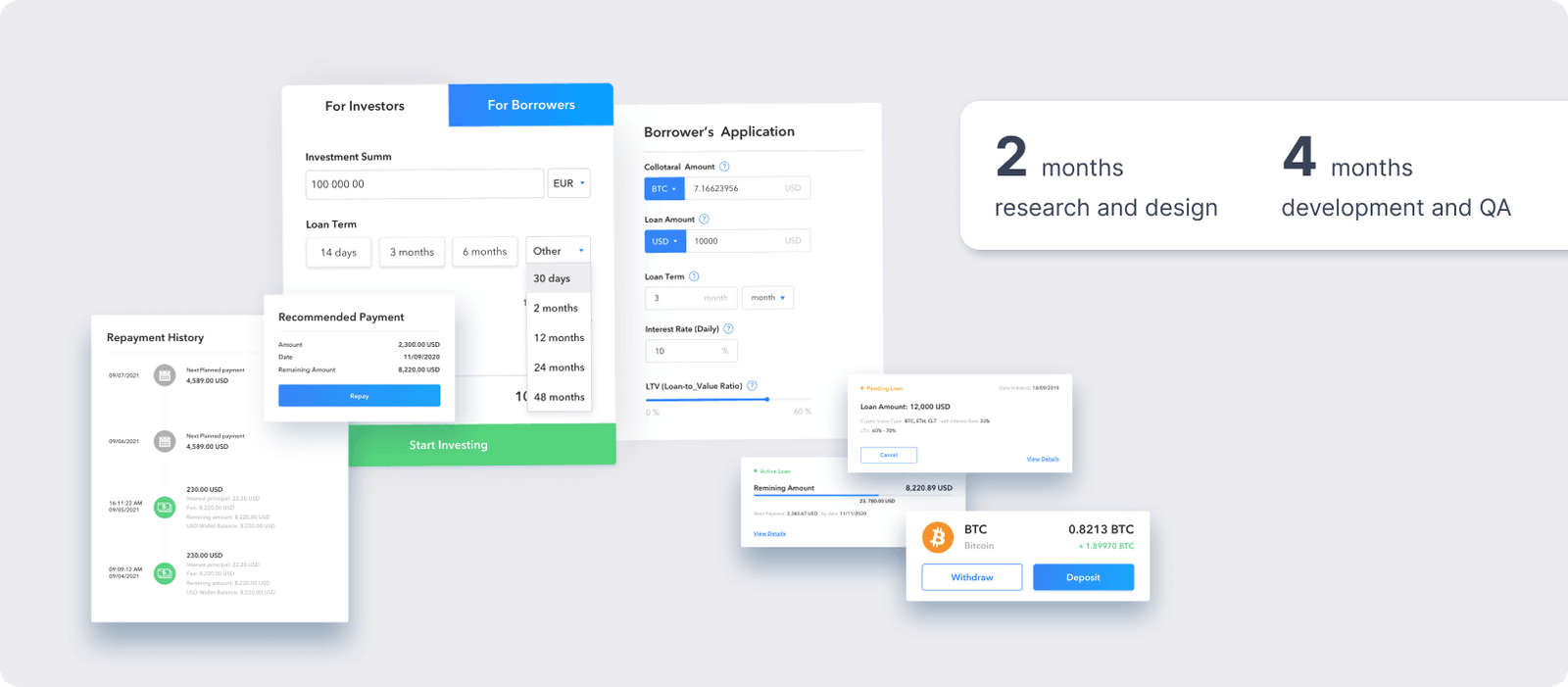

CoinLoan - Web-based P2P Lending Platform

CoinLoan is a web-based P2P lending platform that helps connect lenders and borrowers more efficiently. Our team worked tirelessly to give CoinLoan a user-friendly, simple, and intuitive design that allows users to make transactions quickly.

The app features advanced security features like two-factor authentication, SSL-encryption, and risk mitigation features to protect the borrower's and lender's investments.

Conclusion

The personal finance app market has significant potential for innovation, and there are many opportunities for development. From our experience, designing and developing a personal finance app that aligns with the target audience's needs is crucial for success. Ensuring data security and privacy, testing through the Agile process, monetization strategies, and app store optimization are necessary steps for commercial success.

If you are looking for a development team to help you build your personal finance app, contact Artkai today to learn more about our experience and expertise.

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.