April 11, 2023

How to Build a Robo Advisor for Investment Firm

Investment firms are always looking for ways to streamline and optimize their operations. One solution that has gained popularity in recent years is the use of robo advisors. A robo advisor is a digital platform that uses algorithms to manage investment portfolios.

In this article, we will provide a step-by-step guide on how to build a robo advisor for your investment firm.

Understanding Robo Advisors

Simply put, a robo advisor is a digital platform that uses mathematical algorithms to provide automated financial advice. The use of robo advisors has grown in popularity in recent years due to their ability to provide personalized financial advice at a lower cost than traditional human advisors.

Robo advisors are especially useful for those who are just starting their investment journey and may not have a large portfolio to manage. They are also useful for those who prefer a more hands-off approach to investing.

Benefits of Robo Advisors for Investment Firms

Robo advisors offer many benefits for investment firms. For example, they can help reduce costs by automating many of the tasks that are traditionally performed by human advisors. Additionally, robo advisors can offer more personalized financial advice than traditional advisors, which can help attract and retain clients.

Robo advisors can also help investment firms to scale their business. With traditional advisors, the number of clients that can be served is limited by the number of advisors available. However, with robo advisors, investment firms can serve a larger number of clients without needing to hire additional staff.

Key Components of a Robo Advisor

There are several key components that are needed to build a robo advisor:

- Data collection and analysis tools: These tools are used to collect and analyze client information, such as income, investment goals, and risk tolerance. This information is then used to create personalized investment portfolios for each client.

- An algorithm for making investment decisions: This algorithm uses the client information collected by the data collection and analysis tools to make investment decisions. The algorithm takes into account factors such as the client's risk tolerance, investment goals, and time horizon.

- An interface for clients to interact with the platform: This interface allows clients to view their investment portfolio, track their progress, and make changes to their investment strategy if necessary.

- A database to store client information and investment data: This database stores all of the client information collected by the data collection and analysis tools, as well as the investment data generated by the algorithm.

Overall, robo advisors offer a convenient and cost-effective way for individuals to invest their money. They provide personalized investment advice and can help individuals achieve their financial goals. Investment firms can also benefit from using robo advisors by reducing costs and scaling their business.

Planning Your Robo Advisor Project

Robo advisors are becoming increasingly popular for investors who want to manage their investments without the help of a traditional financial advisor. However, building a successful robo advisor requires careful planning and consideration of your target audience, goals and objectives, and key features and functionality.

Defining Your Target Audience

The first step in building a successful robo advisor is to define your target audience. This will help you design a platform that meets the specific needs of your clients. For example, some clients may be more risk-averse than others, so your robo advisor algorithm should be designed to take this into account.

It's important to consider factors such as age, income level, investment experience, and risk tolerance when defining your target audience. By understanding your clients' needs and preferences, you can create a robo advisor that provides a personalized and effective investment experience.

Establishing Goals and Objectives

Once you have defined your target audience, the next step is to establish your goals and objectives. For example, you may want to maximize returns for your clients while minimizing risk. Or you may want to offer a more personalized experience than your competitors.

It's important to set realistic goals and objectives that align with your target audience and your business objectives. This will help you create a robo advisor that meets the needs of your clients while also achieving your business goals.

Identifying Key Features and Functionality

Once you have established your goals and objectives, the next step is to identify the key features and functionality that your robo advisor will need. For example, you may want to offer clients the ability to customize their investment portfolios or to provide educational resources to help them make informed investment decisions.

Other key features and functionality to consider include automated rebalancing, tax-loss harvesting, and portfolio analysis tools. By offering a comprehensive suite of features and functionality, you can create a robo advisor that provides a complete investment experience for your clients.

In conclusion, building a successful robo advisor requires careful planning and consideration of your target audience, goals and objectives, and key features and functionality. By taking the time to plan your robo advisor project, you can create a platform that meets the needs of your clients and helps you achieve your business goals.

Choosing the Right Technology Stack

Building a robo advisor platform requires careful consideration of the technology stack. The right programming languages and frameworks, data storage and management solutions, and third-party API integrations can make all the difference in creating a robust and scalable platform.

Programming Languages and Frameworks

Choosing the right programming languages and frameworks is crucial when building a robo advisor. At Artkai, we recommend using languages like Python or Java, and frameworks like Django or Flask. These technologies offer the scalability and flexibility needed to build a robust robo advisor platform.

Python is a popular choice for robo advisors due to its simplicity and ease of use. It has a large community of developers and a wide range of libraries and frameworks available. Java, on the other hand, is known for its scalability and reliability. It can handle large amounts of data and is often used for mission-critical applications.

Frameworks like Django and Flask are also popular choices for building robo advisors. Django is a high-level Python web framework that encourages rapid development and clean, pragmatic design. Flask, on the other hand, is a micro web framework that is easy to use and has a small footprint.

Data Storage and Management Solutions

Robo advisors require a lot of data storage and management. At Artkai, we recommend using cloud-based solutions like Amazon Web Services or Microsoft Azure. These platforms offer scalable, cost-effective solutions for storing and managing large amounts of data.

Amazon Web Services (AWS) is a popular choice for robo advisors due to its scalability, reliability, and security. It offers a wide range of services, including data storage, database management, and machine learning. Microsoft Azure is also a popular choice, offering similar services and scalability.

When choosing a data storage and management solution, it's important to consider factors like scalability, security, and cost. Cloud-based solutions like AWS and Microsoft Azure offer the flexibility and scalability needed to handle large amounts of data, while also providing robust security features to protect sensitive information.

Integrating with Third-Party APIs

Integrating with third-party APIs is a crucial part of building a robo advisor platform. For example, you may need to integrate with trading platforms or financial news sources to ensure that your algorithm is up-to-date with the latest market information. At Artkai, we have experience integrating with a wide range of APIs, ensuring that your robo advisor platform is always up-to-date and accurate.

Integrating with third-party APIs can be complex, and requires careful consideration of factors like data security, reliability, and compatibility. At Artkai, we have a team of experienced developers who can help you navigate the complexities of API integration, ensuring that your robo advisor platform is always up-to-date and accurate.

Overall, choosing the right technology stack is crucial when building a robo advisor platform. By carefully considering factors like programming languages and frameworks, data storage and management solutions, and third-party API integrations, you can create a robust and scalable platform that meets the needs of your users.

Designing the User Interface and Experience

Designing a robo advisor platform is not just about creating a functional system that automates investment management. It's also about creating a user-friendly interface that clients can easily navigate and understand. At Artkai, we believe that a well-designed user interface and experience is critical to the success of any robo advisor platform.

Creating an Intuitive User Interface

When designing the user interface for your robo advisor platform, we focus on creating an intuitive layout that is easy to navigate. This includes using clear and concise language, avoiding cluttered screens, and using visual cues to guide users through the platform.

We also understand that the user interface should be visually appealing. Our team of designers works closely with clients to create a platform that reflects their brand and values, while also being aesthetically pleasing to users.

Another important aspect of the user interface is providing all the necessary information in a clear and concise format. We understand that clients want to quickly and easily access information about their investments, so we design the platform to make this information readily available.

Ensuring a Seamless Onboarding Process

The onboarding process is the first interaction clients have with your robo advisor platform, and it's essential to make a good first impression. At Artkai, we strive to create a seamless onboarding process that makes it easy for clients to sign up and start using your platform right away.

We understand that clients may have questions or concerns during the onboarding process, so we provide clear and concise instructions, as well as access to support if needed. Our goal is to make the onboarding process as smooth and stress-free as possible.

Implementing Responsive Design for Mobile Devices

With more people accessing online platforms via mobile devices, it's essential to ensure that your robo advisor platform is optimized for mobile use. At Artkai, we use responsive design techniques to ensure that your platform looks and works great on any device.

Responsive design means that the platform will automatically adjust to the size of the screen it's being viewed on, making it easy to use on smartphones, tablets, and other mobile devices. This is essential for providing a seamless user experience, regardless of the device being used.

In conclusion, designing the user interface and experience for a robo advisor platform is a critical part of its success. At Artkai, we understand this and work closely with clients to create a platform that is intuitive, visually appealing, and optimized for mobile use.

Developing the Algorithm and Investment Strategies

When it comes to developing an effective algorithm for a robo advisor, there are several key factors to consider. One of the most important is having a deep understanding of modern portfolio theory. This theory is based on the idea that investors can maximize returns by holding a diversified portfolio of assets. By spreading investments across different asset classes, such as stocks, bonds, and real estate, investors can reduce their overall risk and potentially increase their returns.

Understanding Modern Portfolio Theory

Modern portfolio theory was first introduced by Harry Markowitz in the 1950s. It is based on the idea that investors should focus on the overall risk and return of their portfolio, rather than just the performance of individual stocks or other investments. By diversifying their investments, investors can reduce the risk of their portfolio while still potentially achieving higher returns. This is because different asset classes tend to perform differently under different market conditions.

For example, during a recession, stocks may perform poorly while bonds and other fixed-income investments may perform better. By holding a diversified portfolio, investors can mitigate the impact of any one asset class performing poorly.

Incorporating Risk Tolerance and Investment Goals

Another important factor to consider when developing a robo advisor algorithm is the risk tolerance and investment goals of your clients. Different clients will have different levels of risk tolerance and different investment goals. Some clients may be willing to take on more risk for higher potential returns, while others may prefer more conservative investments that prioritize capital preservation over growth.

By taking into account each client's risk tolerance and investment goals, you can create a customized investment strategy that is tailored to their individual needs. This can help to improve client satisfaction and potentially increase the likelihood of them sticking with your robo advisor over the long term.

Continuously Updating and Improving the Algorithm

Finally, it's important to remember that developing a robo advisor algorithm is an ongoing process. As market conditions change, it's crucial to continuously update and improve your algorithm to ensure that it is always performing at its best.

At Artkai, we understand the importance of staying up-to-date with the latest market trends and making adjustments to our algorithms as needed. We regularly review our algorithms and make updates to ensure that they are performing optimally for our clients.

Overall, developing an effective robo advisor algorithm requires a deep understanding of modern portfolio theory, as well as a focus on each client's individual risk tolerance and investment goals. By continuously updating and improving your algorithm, you can help to ensure that your clients achieve their investment objectives and remain satisfied with your services over the long term.

Ensuring Security and Compliance

Protecting User Data and Privacy

Security is a top concern when building any online platform, and robo advisors are no exception. At Artkai, we follow best practices for data security and privacy to ensure that your clients' information is secure and protected.

Complying with Financial Regulations

Robo advisors are subject to a range of financial regulations, and it's essential to ensure that your platform is compliant with all applicable laws and regulations. At Artkai, we have experience building robo advisor platforms that are compliant with regulations like FINRA and SEC.

Implementing Robust Security Measures

To ensure that your robo advisor platform is secure, we implement robust security measures like multi-factor authentication, data encryption, and regular security audits and scans.

Testing and Launching Your Robo Advisor

Conducting Thorough Testing and Quality Assurance

Before launching your robo advisor platform, it's essential to conduct thorough testing and quality assurance to ensure that it works correctly and meets your clients' needs. At Artkai, we have a dedicated testing and QA team that works to identify and fix any bugs or issues before launch.

Gathering User Feedback and Making Improvements

After launching your robo advisor platform, it's essential to gather user feedback and make improvements based on that feedback. At Artkai, we use tools like user feedback surveys and analytics to gather insights into how your clients are using the platform and what changes or improvements they would like to see.

Marketing Your Robo Advisor to Attract Clients

As a customer-centric digital product development agency with a proven track record, Artkai can help you effectively market your robo advisor platform to attract new clients. We can provide you with a range of marketing services, including social media marketing, paid advertising, and content marketing.

Monitoring and Maintaining Your Robo Advisor

Tracking Performance Metrics and User Satisfaction

After launching your robo advisor platform, it's essential to track performance metrics and user satisfaction to ensure that it's meeting your goals and objectives. At Artkai, we use a range of tools and techniques to track performance metrics like ROI and user satisfaction.

Regularly Updating and Enhancing Features

To remain competitive in the marketplace, it's essential to regularly update and enhance your robo advisor platform's features. At Artkai, we use agile development methodologies to ensure that new features and updates are delivered quickly and efficiently.

Providing Ongoing Customer Support and Education

Effective customer support and education are crucial for ensuring that your clients are happy with your robo advisor platform. At Artkai, we provide ongoing customer support and education services to ensure that your clients are getting the most out of the platform.

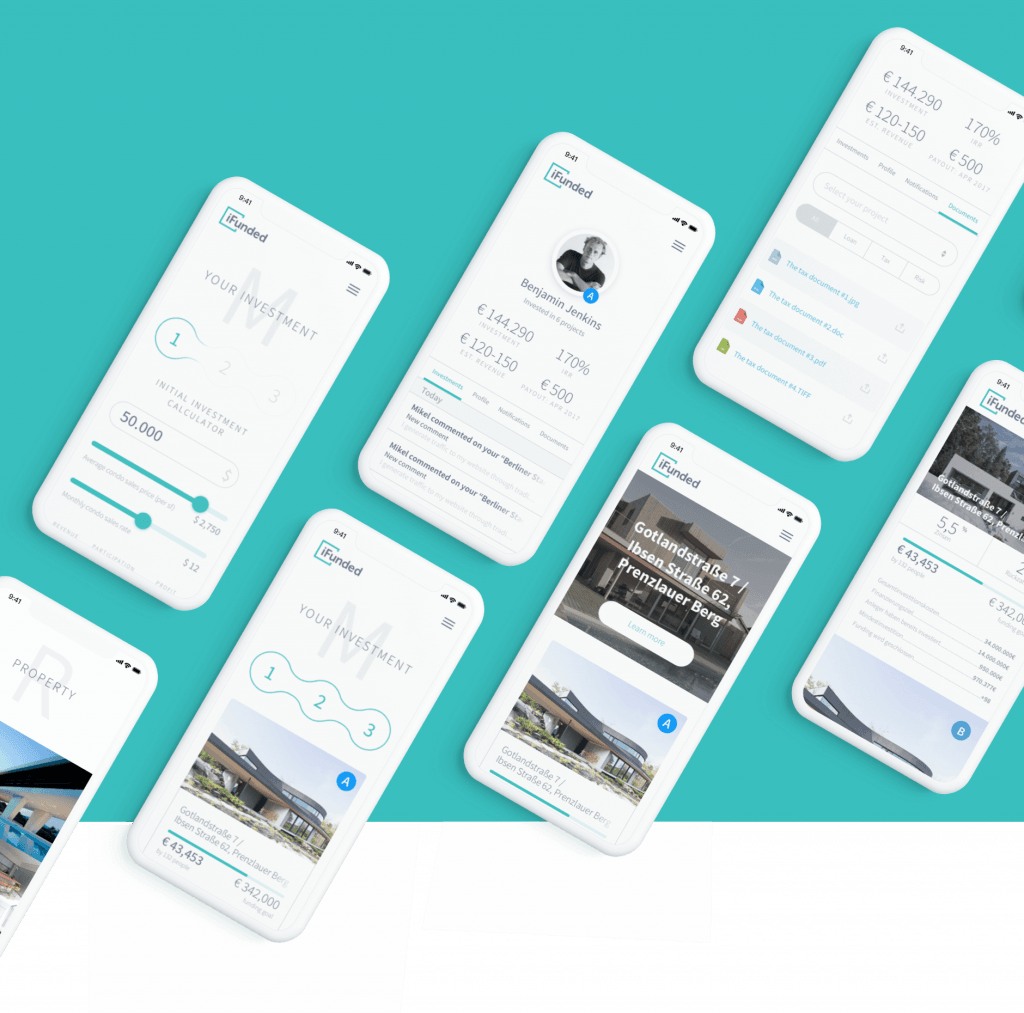

Successful investment product case by Artkai

Here is an example of how Artkai helped investment company build an incredible product.

Building a user-friendly investment platform

Summary

Our client wanted to open the world of real estate crowdfunding to the underdeveloped and strictly regulated German market. The idea was to significantly simplify real estate financing for both investors and developers through state-of-the-art technology. By combining our digital know-how with the client’s extensive experience in the real estate industry, we have built a trustworthy, easy-to-use, and stylish web-based platform from scratch.

Solutions:

- Easy registration where users can quickly pass through the German market identification process and become a few steps closer to their dream home.

- Overview of investment deals to track actual distributions and compare these with the forecasted return expectations.

- Instant access to a personal dashboard where users get to review all the essential information about investment deals as well as track actual distributions and monitor their progress online.

- Visual design where all components work smoothly to allow users to stay focused on the content.

Outcome

Through joint efforts, we have built a one-of-a-kind digital platform with usability being the main selling point of the brand. The product makes global real estate investments highly accessible, simple and transparent with no extra fees. Most importantly, the product turned out to be a great help to users, as it simplifies a complex and stressful process.

For more illustrations and details on how we handled the challenge, check out the iFunded case study.

Conclusion

As you can see, building a robo advisor platform requires a range of skills and expertise. At Artkai, we have the experience and expertise needed to help you build a robust, secure, and effective robo advisor platform.

Contact us today to learn more about how we can help you build a platform that meets your clients' needs and exceeds your goals and objectives.

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.