June 23, 2021

Financial wellness application for individuals & enterprises developed from the ground up by Artkai

Red Rocks Credit Union is a full-service financial institution that offers competitive deposit & loan products along with quality member service. Located in Denver, USA, they offer various low-rate, affordable financing solutions to help their customers get on the path to lower payments and eliminate their debts.

Table of contents:

The mission of the company goes as follows: 'Financial wellness journey made easy.' To propel this mission and grow their clientele, the founders came up with an idea of a Red Rocks application — a digital financial wellness solution targeted at B2B clients exclusively. The owners chose to pilot this idea in the U.S. and potentially expand the offering to the U.K. and Europe. With this concept, Red Rocks came to Artkai.

The Core Value & Target Audience

The idea behind the app was that companies that are interested in their employees' financial well-being invest in the Red Rocks application and, thereby, achieve the following goals:

For C-level representatives:

- Facilitate employee engagement programs in the company

- Propel in-company communication

- Support new & existing employee engagement programs: 401(k), health insurance, charity programs

- Evaluate the effectiveness of the engagement programs

- Boost financial intelligence across the company

- Increase employees' loyalty and performance at work and dedicate all their focus towards their day-to-day operations

For employees:

- Localize and solve their financial needs

- Improve their financial habits

- Gradually eliminate existing debt

- Gain control over their finances

- Realize their financial goals

What makes this concept stand out is that it has no analogs on the market. While various financial applications solved the same problems, all of them were concentrated on B2C users. As for the enterprise sector, there was no all-in-one financial wellness app for this customer type. That's where the Red Rocks app wins the competition, and that's what created the unique challenge for Artkai.

The Challenge

When the client came to Artkai, all they had was the abstract idea with an analog theoretical framework of Financial Journey for individuals and no straight tech task specification. We had to convert the theoretical concept into several possible solutions, then into the live prototype, and then into a scalable application. All this we had to do from scratch, making sure various components work together as a digital ecosystem for both individual users and the community.

Constrains

The main constraint that added difficulty was the need to remotely understand the financial field and landscape in the U.S. As all the work was done remotely, we had to thoroughly research the nuances and specificities of the U.S. financial market. We also had to foresee the possible technical obstacles our client can face regarding the services inside the application.

Process & What We Did

1. Requirements gathering

Everything begins from researching and documenting the client's needs, pains, and problems and exploring the project field from start to finish. Requirements gathering answers the following questions:

- What are the risks?

- What resources do we need/lack?

- Are there any budgeting issues or shortcomings?

- What is the overall impact of those issues or shortcomings?

2. Product discovery

Product discovery plays a key role in helping our product team decide which features or products to prioritize and build. At this stage, we dig deeper into the client's perspective of the research problem, their context, perceptions, internal conflicts, or interplays that may emerge during the project.

3. Customer research

During the customer research phase, we analyze the app's target audience's preferences, attitudes, motivations, and buying behavior from both stakeholder and user perspectives. As a result of the discovery, around 80% of the surveyed employees said that they'd be glad to have such a financial wellness digital guide, which meant a lot.

4. Competitor analysis

After understanding the target customer, we start identifying the competition: what they offer, what are their products and services' strengths and weaknesses. Here, we gather insights for future product finetuning and positioning.

4. Desk research

Desk research is a so-called "secondary research" when we gather publicly available information about the market and consolidate it into a report to reflect the objective market landscape. Our desk research was focused on finances in the USA: legal, regulatory, and human aspects of digital banking, money-saving, and other finance-related mobile solutions.

5. Qualitative & quantitative data gathering & analysis

At the stage of laying out the development research hypothesis, we had to collect and analyze data about everything that constitutes the future app: charity programs, decision-making processes inside the company, KPIs measuring, employee engagement programs, etc. We did it by conducting unmoderated remote surveying.

6. Personas development

Personas Development is an accurate description of the key user groups that will be using the solution, documented and described verbally through their common pains, gains, desires, and tools they were to use within the solution.

7. Customer journey mapping

Customer journey mapping focuses on your customers' interactions with your product. It visualizes a particular user's experience in a specific scenario to reveal the weak points in the solution.

8. Gamification techniques implementation

We decided that implementing gamification concepts in the application is a great way to engage employees in the Financial Journey concept in a healthily addictive way. No "dark pattern" tricks!

9. Ideation and brainstorming sessions

Ideation and brainstorming sessions helped us generate more ideas, evaluate them with the client, and systematically prioritize them while working as a team. This is an essential step before creating a backlog.

10. Prioritization & backlog gathering

Backlog is a straightforward project roadmap with prioritized tasks and deadlines that helped our creative team to finalize complex design deliverables in time.

11. Visual concept

During the visual conceptualization, our designers solved the challenge of a "white-label" application - a type of application that can be customized and rebranded according to the organization's needs. Our team provided the concept of the customizable design connecting it with IOS guidelines but still keeping the emotional message the app needs to translate.

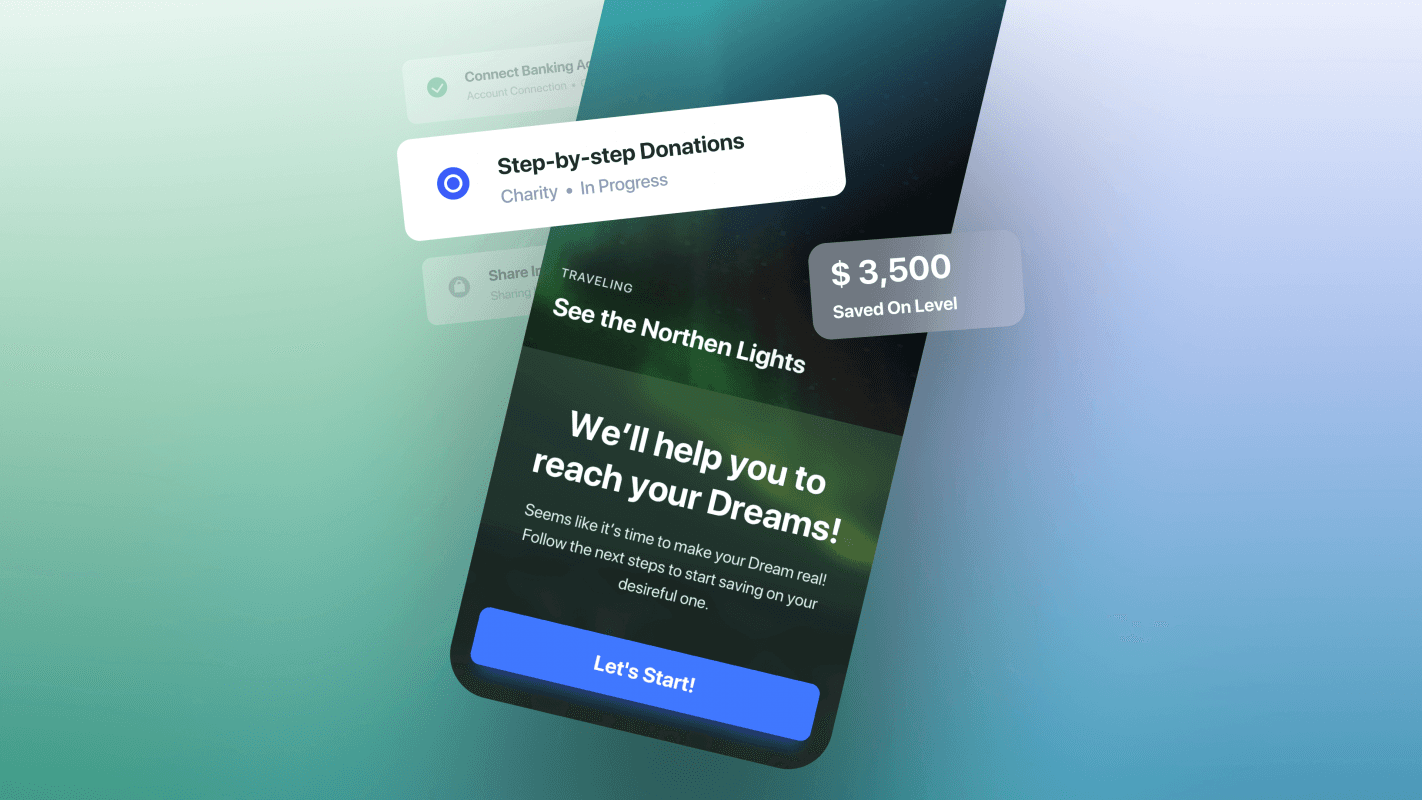

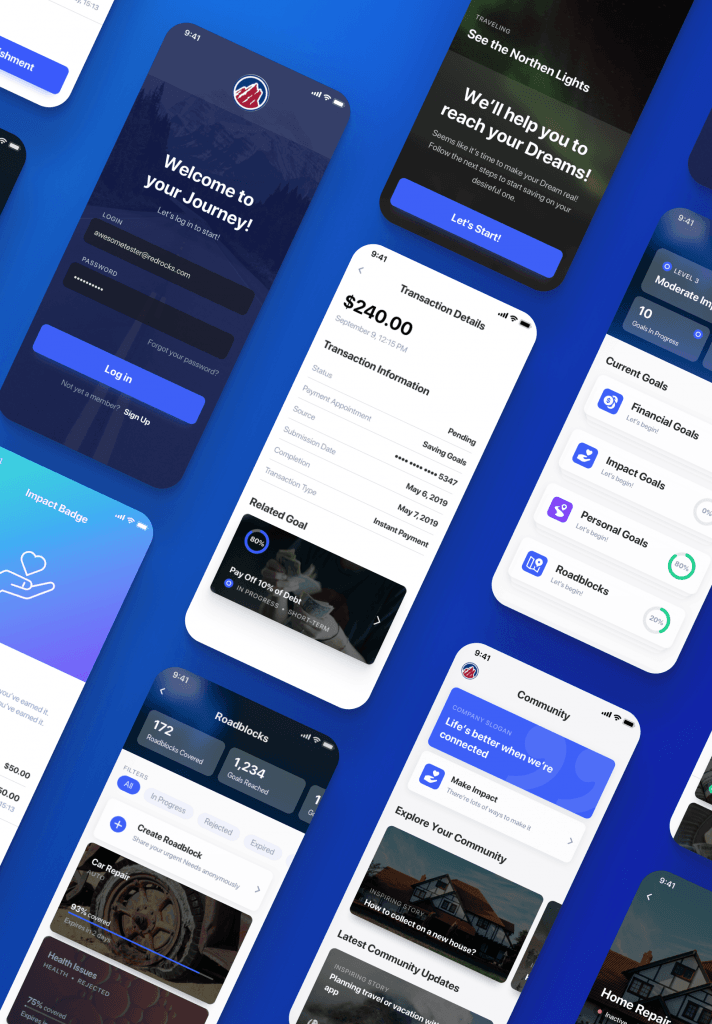

12. Creation of a high-fidelity IOS application prototype

A high-fidelity prototype is a computer-based interactive representation of the product in its closest resemblance to the final design in terms of details and functionality. From the design on the structural level to micro-interaction animations – the Artkai design team nailed it all.

13. Usability testing

As the Journey concept presented by the client was quite difficult to explain, we had to test several possible approaches to onboarding storytelling. The testing helped us understand how to adapt the onboarding for the users to understand the central concept.

Solutions We Came up With

The App for individuals & enterprises

As a result, we designed an iOS application that supports feature sets relevant for both individual users and the group of users formed into the community & enterprises.

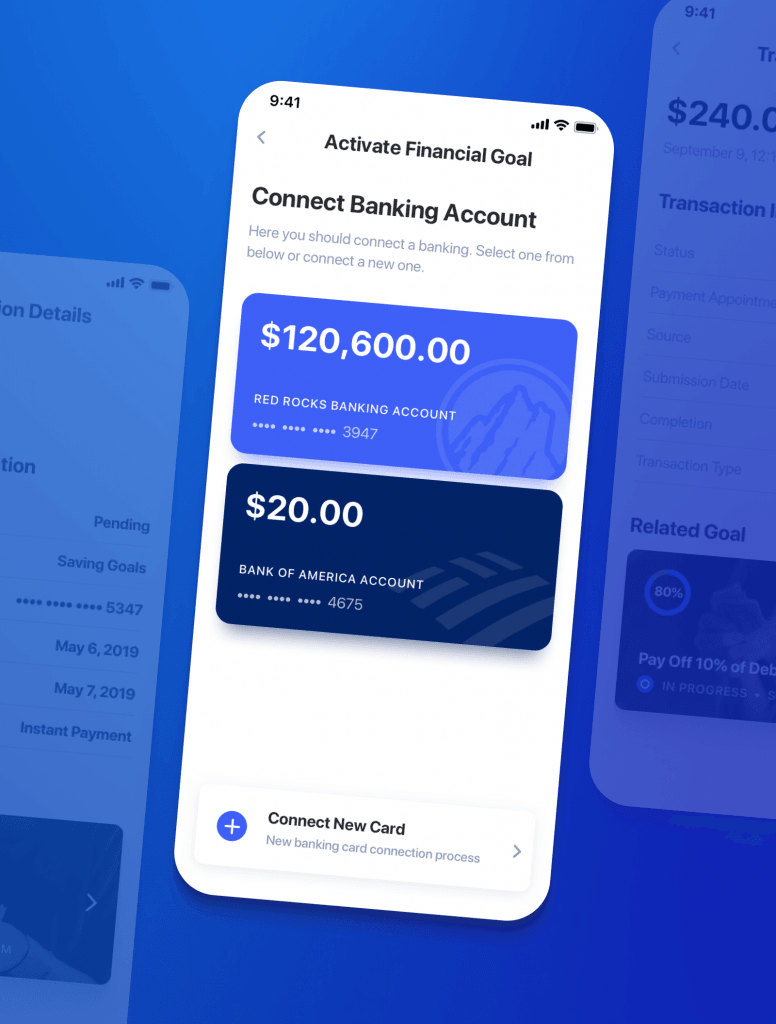

Digital banking

The application's concept required us to develop essential digital payment functions like connect different bank cards and perform specific transactions. The Artkai team covered all the requirements and added all the needed digital banking functionalities.

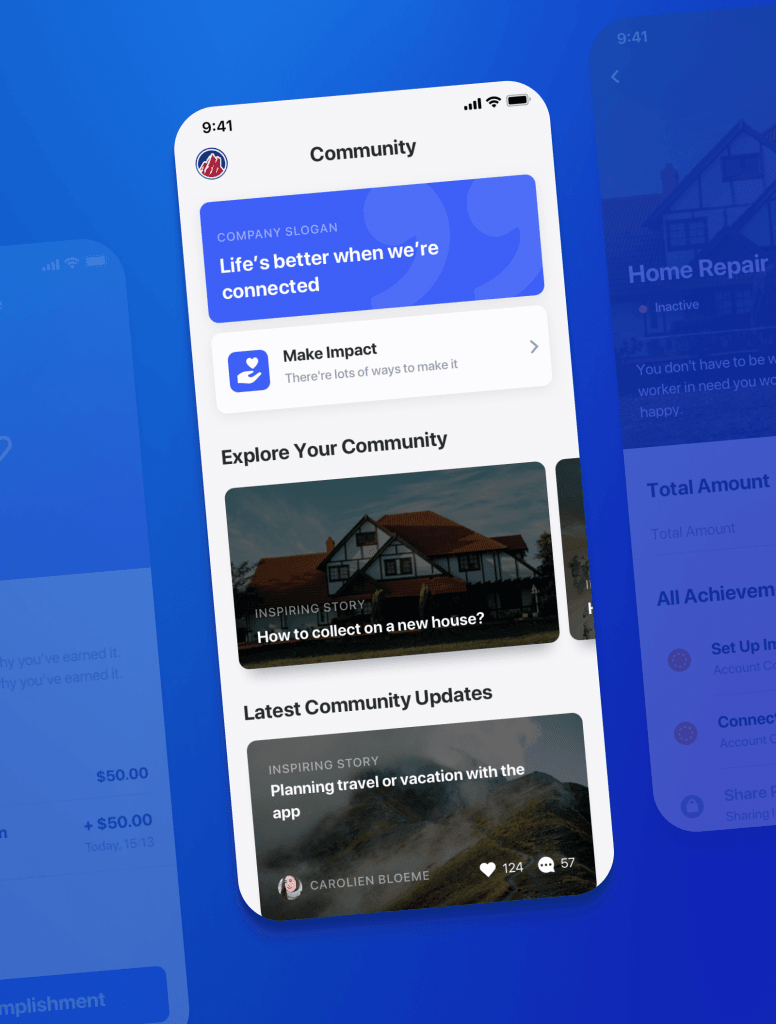

Collaboration & community connection functionality

One of the main framework ideas behind the app was to raise the community's attention to charity and help colleagues in financial need. We provided an opportunity for users to:

- share their current financial difficulties

- support charity organizations

- make anonymous contributions to support community members in need

Engaging logic with gamification elements

Solutions were developed with gamification mechanics in mind to raise user engagement. For that, we implemented the monetary rewards system that triggers users to take action inside the app.

Strong security

As the application works as a financial support tool, the importance of solid security was undeniable. User's both personal & financial data protection comes at the forefront while developing apps for financial organizations.

Anonymous crowdfunding

It is always hard for a person to admit to society that they don't have the money to deal with a depressing financial situation. This aspect of user behavior in the community has led us to conclude that the mechanics of fundraising should be anonymous crowdfunding.

Conclusion

The Red Rocks Credit Union project - digitalization of the corporate financial wellness framework in IOS application format - was successfully accomplished. We've put savings, wealth building & investing at the core of potential user interest. Hence, the solution received a lot of positive feedback across the companies. This application has become especially vital now, amid the continually evolving global downturns, which only proved both the concept usefulness and the execution quality.

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.