P2P loan platform that can be integrated into any TRON dApp

Users can use platform as collateral to gain interest while giving funds to someone who really need it.

OVERVIEW

About the business

Loyalty loan is a digital assets-backed loan with marketplace opportunities. Its primary purpose is to allow crypto holders to get fiat money without selling their digital assets. They combine the best of traditional and novel finance to offer both solid security and favorable terms. It is sophisticated software with the possibility of getting a loan and the opportunity to lend money.

Users can use dApp tokens as collateral to earn interest at appropriate rates by offering funds to borrowers. The platform can be integrated into any frame size dApp with an easy-to-configure API.

OVERVIEW

Project tasks

- Create a web-based solution for loan takers, lenders, and crypto exchange

- Enable integration with a variety of financial institutes

- Combine the best blockchain and finance management platform features within one solution

- Make an intuitive and understandable user-flow for the app

- Build a strong and consistent UI system

OVERVIEW

Project team

Team: UI/UX designer, 2 Front-end engineers, Back-end engineer, Blockchain engineer, Solutions Architect, QA engineer, DevOps, Project manager, Business analyst.

3

months for research and UX/UI design

4.5

months for front-end and back-end development

Design and development are done in parallel after the research and discovery phase.

OVERVIEW

Tech stack

TypeScript

Angular

NGRX/RXJS

Ionic

Node.js

AWS

PostgresQL

REST

Swagger

Socket.io

GraphQL

Solidity

Tron

WEB3

Get a quote

or free consultation

PROJECT JOURNEY

Product development

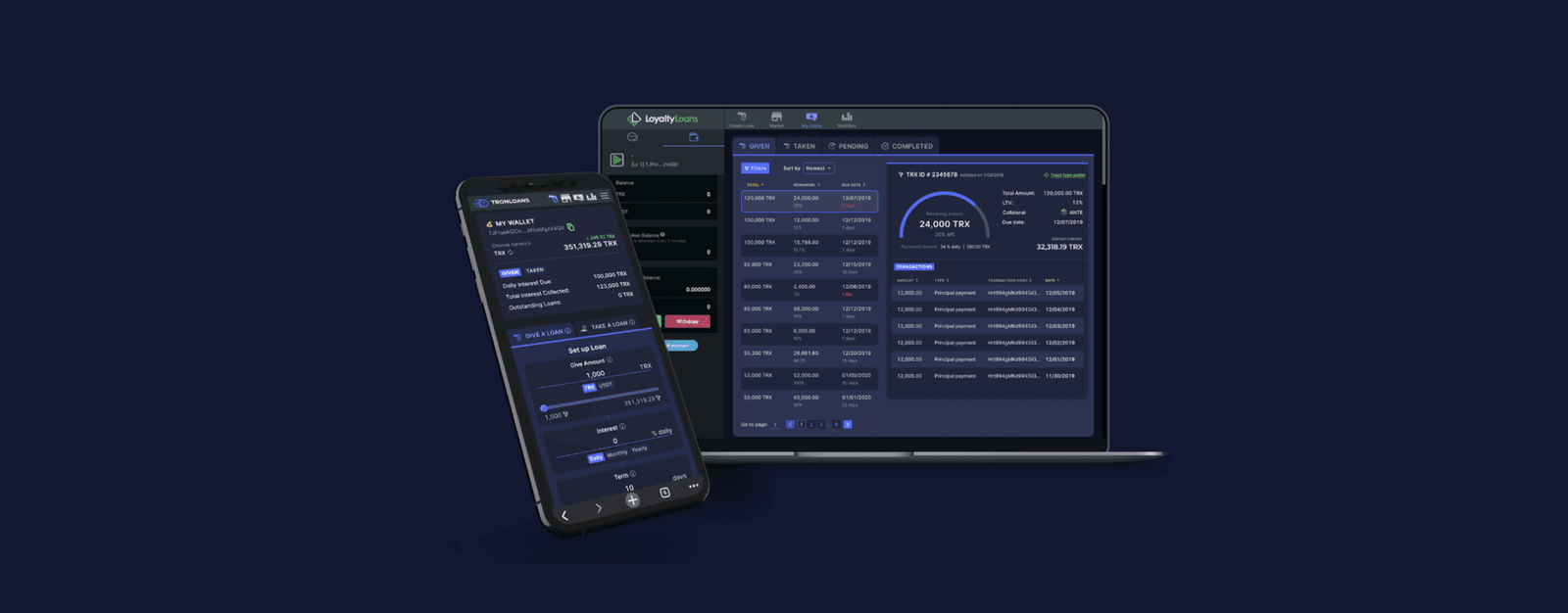

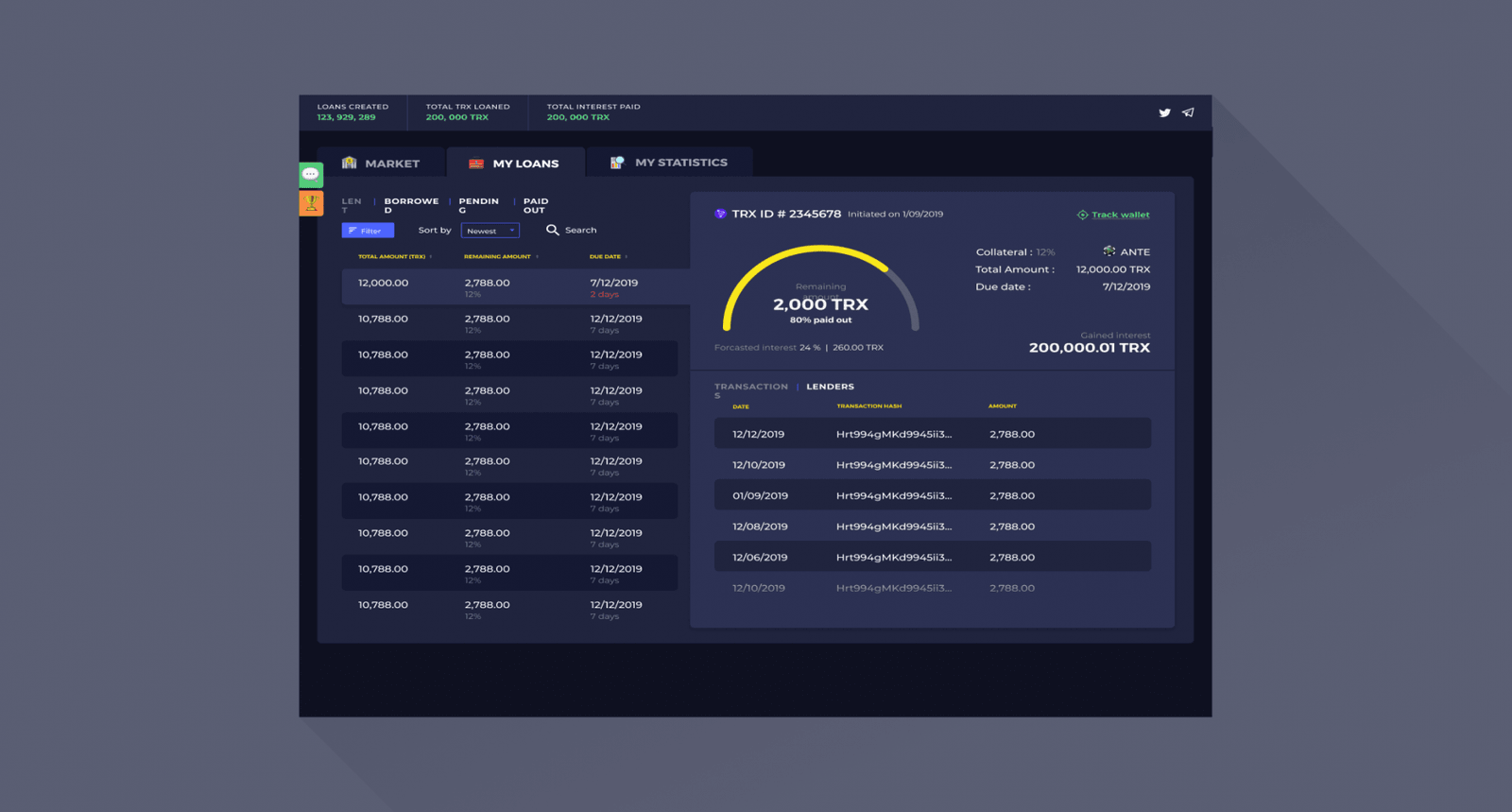

Loyalty Loans. My loans page.

Core idea

Asset-based digital finance platform allows the user to track all transactions that he carries out. Access to the market, previous loans, and statistics are always accessible easily through an account. The flexible configuration of the platform simplifies and speeds up the work. The complex algorithm allows users to make transactions on purchase, sale, and exchange quickly and do it as personalized as possible.

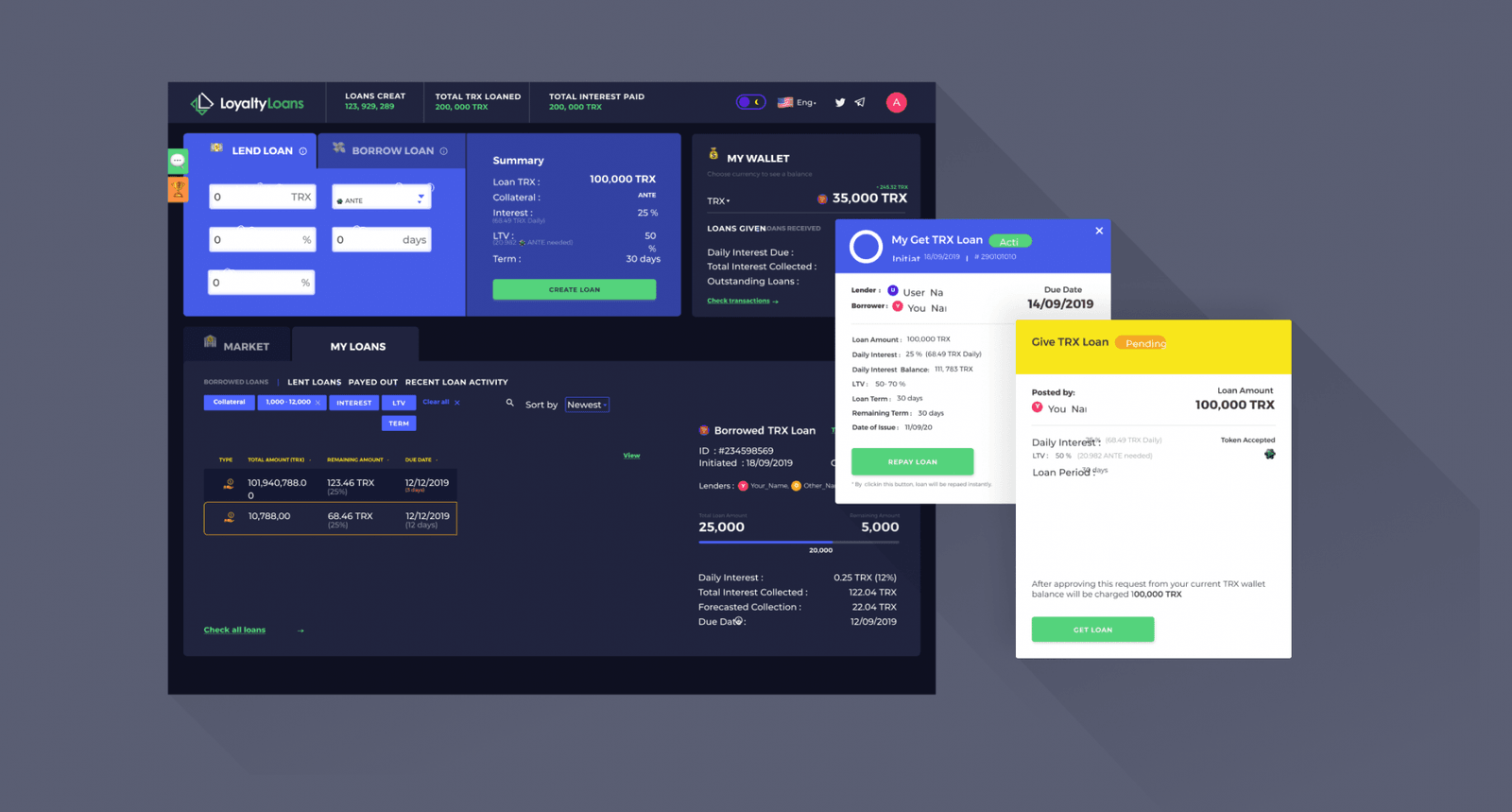

Platform functionality

Digital Assets-backed Loans

The platform allows crypto holders to borrow fiat money by using their digital assets as collateral. The system can assess the value of the collateral and offer loans based on the borrower's digital assets' worth.

Marketplace Opportunities

The platform provides a marketplace where users can lend or borrow funds using digital assets. Borrowers can access funds, and lenders can earn interest on their funds by lending them to borrowers.

Solid Security

The platform provides solid security to users' digital assets and funds by using appropriate security protocols such as multi-signature wallets and cold storage.

Favorable Loan Terms

The platform offers favorable loan terms to borrowers, such as low-interest rates and flexible repayment options, allowing them to retain ownership of their digital assets while accessing fiat money.

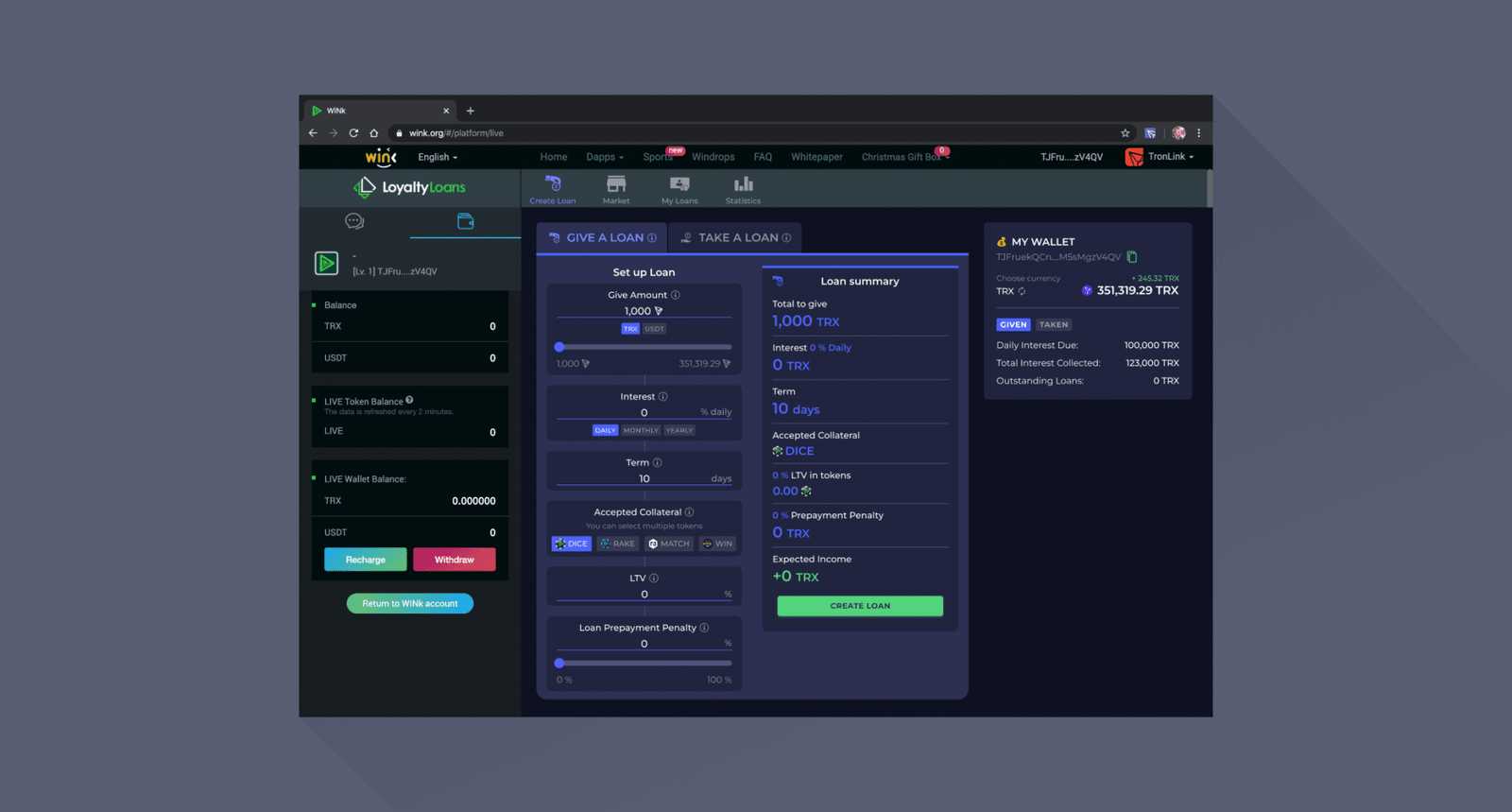

Loyalty Loans. Give a loan page.

Digital Asset Evaluation

The platform has an algorithm that can evaluate the value of the borrower's digital assets and offer loans based on their worth.

Integration with dApps

The platform can integrate with any dApp of any size with an easy-to-configure API, making it easily accessible to users.

Earn Interest

Users can earn interest by lending funds to borrowers through the platform. The system can assess the creditworthiness of the borrower and offer appropriate interest rates to lenders.

User-friendly interface

The platform may have a user-friendly interface that allows users to access and manage their accounts, view their loans and interest earned, and monitor the status of their digital assets.

User Verification

The platform may require users to complete a transparent ID verification process to ensure that they meet the platform's requirements and comply with regulatory requirements.

Collateral Management

The platform may offer collateral management services to help prevent risks associated with digital assets' value fluctuations. This may include automatically liquidating collateral if the value falls below a certain threshold.

Loyalty Loans. Interface.

Loan Application

Users can create a loan application with flexible terms and loan amount setup, allowing them to choose the loan amount, interest rate, and repayment period that best suits their needs.

Early Repayment

The platform may allow borrowers to make early loan repayments without penalty, allowing them to save on interest charges and improve their creditworthiness.

Native Token Minting and Distribution

The platform may offer a native token in the ERC-20 format, which users can use to access platform services, earn rewards, and pay for loan fees.

Loan Progress Tracking

Users can track the status of their loans, view their repayment schedule and interest accrued, and monitor the progress of their loan applications.

OUTCOME

Outcome

The Loyalty loan solution offers a sophisticated platform that allows users to access funds without selling their digital assets. The platform combines the best of traditional and novel finance to offer both solid security and favorable terms to users. It provides an opportunity for users to lend or borrow funds using digital assets, earn interest, and integrate with any dApp of any size with an easy-to-configure API.

Read More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.