June 30, 2023

Buy Now, Pay Later (BNPL) Software Development Guide

In recent years, the Buy Now, Pay Later (BNPL) industry has quintupled in size, with consumers opting for interest-free and deferred payment options for online shopping. From our experience at Artkai, we recognize the significance of offering BNPL solutions to businesses and, consequently, the importance of secure and efficient software development.

This software development guide explores the BNPL landscape, planning and development processes, technology stacks, testing and quality assurance, launching and marketing strategies, and the maintenance and updating of BNPL software to stay ahead of industry trends while adhering to evolving regulations.

Understanding the BNPL Landscape

As a customer-centric digital product development agency with a proven track record, we understand that a thorough understanding of the BNPL market is vital to developing BNPL software that meets evolving customer expectations and business regulatory requirements.

Key Players in the BNPL Market

BNPL offerings from market leaders such as Klarna, Affirm, Afterpay, and QuadPay have surged their way to fame due to their unique offerings.

- Klarna, a Swedish fintech company, has been making waves in the BNPL market with its "buy now, pay later" option. The company has partnered with over 200,000 merchants, including H&M, Sephora, and Adidas, to offer its BNPL service to customers.

- Affirm, on the other hand, offers installment loans with interest rates ranging from 0% to 30%. Afterpay, an Australian BNPL provider, allows customers to split their purchase into four interest-free payments.

- QuadPay, a US-based BNPL provider, offers customers the option to split their purchase into four interest-free payments as well, but with the added benefit of being able to use the service both online and in-store.

With the BNPL market constantly evolving, it's important to keep an eye on new players and their offerings.

How BNPL Works for Consumers

Firstly, a consumer selects the BNPL option at the check-out. Secondly, they receive an online installment application that takes minutes to fill out and verify. If accepted, they may make the purchase without paying immediately. Instead, they repay the item's cost over a set amount of time, typically without interest.

For consumers who may not have the funds to make a large purchase upfront, BNPL options can be a game-changer. It allows them to spread out the cost of the purchase over time, making it more manageable and affordable. Additionally, with the ease and convenience of the online application process, it's never been easier for consumers to take advantage of BNPL options.

Benefits of BNPL for Businesses

BNPL options increase average order value, drive sales, enhance customer satisfaction, and customer loyalty in the competitive online retail industry.

By offering BNPL options, businesses can increase their customer base and improve customer satisfaction. With the convenience of BNPL options, customers are more likely to complete their purchase and return to the same business for future purchases. Additionally, with the increase in average order value, businesses can see a boost in their revenue and profitability.

It's important for businesses to carefully consider their BNPL options and choose a provider that aligns with their business goals and values.

Planning Your BNPL Software Development

Defining the target audience, identifying key features, and regulatory compliance requirements is just the beginning of pricing BNPL software development. Developing a successful BNPL platform requires a robust and comprehensive strategy that considers various factors.

Defining Your Target Audience

Identifying the target audience for BNPL software development is crucial for building a solution that solves unique challenges and requirements. It enables product owners to offer tailored experiences and features as per customers' specific needs. The target audience for BNPL software development may include millennials, Gen Z, and other digitally-savvy consumers who prefer to pay for goods and services over time rather than all at once.

It is essential to understand the target audience's behavior, preferences, and pain points to design a BNPL platform that resonates with their needs. Conducting market research, analyzing industry trends, and gathering customer feedback can help create a customer-centric BNPL platform that drives user engagement and loyalty.

Identifying Key Features and Functionality

Identifying the essential features and functionality for the BNPL platform focuses software development time on valuable features and allows for a better allocation of project resources. BNPL software may offer myriad features such as deferred payment options, instant approval, and customized payment plans.

Other critical features that can enhance the BNPL platform's usability and appeal include secure payment gateways, fraud detection and prevention, real-time reporting, and analytics. Integrating these features can provide a seamless and secure user experience and help merchants manage their business operations more efficiently.

Regulatory and Compliance Considerations

Regulatory entities must ensure that BNPL platforms adhere to specific regulations, including Anti-money laundering (AML), Know your customer (KYC), Data protection, and PCI-DSS compliance. Failure to comply with these regulations can lead to severe legal consequences, financial penalties, and reputational damage.

It is essential to work with legal and compliance experts to ensure that the BNPL platform meets all regulatory requirements. This includes conducting regular audits, implementing robust data protection measures, and monitoring the platform for suspicious activity.

Developing a successful BNPL platform requires a comprehensive approach that considers various factors such as customer needs, key features, and regulatory compliance. By taking a customer-centric approach and working with legal and compliance experts, businesses can create a BNPL platform that drives user engagement and loyalty while mitigating legal and financial risks.

Choosing the Right Technology Stack

Choosing the appropriate technology stack is crucial for the development of an efficient and secure BNPL platform. BNPL, or Buy Now Pay Later, is a financial service that allows customers to purchase products and pay for them in installments over a period of time.

When it comes to developing a BNPL platform, there are several factors to consider. One of the most important is the technology stack that will be used to build the platform. The right technology stack can make all the difference in terms of performance, security, and user experience.

Backend Technologies for BNPL Software

Backend technologies such as Node.js, Java, and Python are ideal for the transactional processes of BNPL platforms. These technologies are known for their reliability, scalability, and security. They are also highly customizable, which makes them a great choice for building complex financial systems like BNPL platforms.

At Artkai, we have extensive experience in building and integrating backend systems for BNPL platforms. Our team of developers is skilled in using a variety of backend technologies to ensure that our clients' platforms are fast, secure, and reliable.

Frontend Technologies for User Experience

The quality of frontend technology can make or break a BNPL platform. A visually appealing and user-friendly interface is essential for attracting and retaining customers. Hence, our frontend developers primarily utilize React.js, Vue.js, and Angular.js to build visually appealing, responsive platforms. These technologies are known for their flexibility, ease of use, and ability to create dynamic user interfaces.

At Artkai, we understand the importance of user experience in BNPL platforms. That's why we work closely with our clients to design and develop interfaces that are intuitive, easy to use, and visually appealing. Our team of frontend developers is skilled in using a variety of technologies to create engaging user experiences that keep customers coming back.

Integrating with Payment Gateways and APIs

Integrating various payment gateways and APIs is essential for efficient and secure payments processing. At Artkai, we've integrated our BNPL solutions with payment gateways, including PayPal, Stripe, and Square. These payment gateways are known for their security, reliability, and ease of use. They also offer a wide range of features and integrations that make it easy to process payments and manage transactions.

Our team of developers is skilled in integrating payment gateways and APIs into BNPL platforms. We work closely with our clients to understand their specific needs and requirements, and we use our expertise to create customized solutions that meet those needs. Whether you need to integrate with a specific payment gateway or API, or you need to build a custom payment processing system from scratch, we can help.

Developing Your BNPL Software

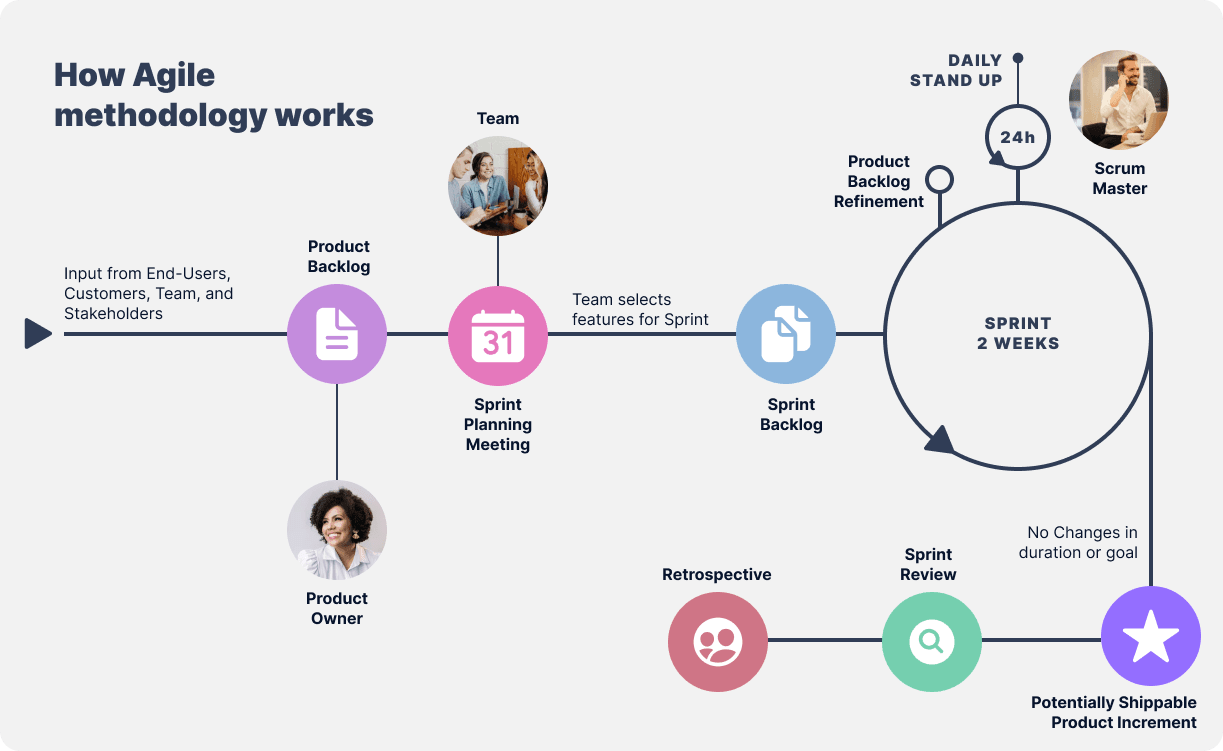

Building robust, secure, and scalable BNPL software requires an agile methodology of development, building a scalable architecture, and maintaining data security and privacy.

Agile Methodology for BNPL Development

An Agile method of development ensures that BNPL software development is efficient and iterative, minimizing market entry time and saving project costs. Agile methodology is a process that involves continuous iteration and feedback. Developers work in short sprints, each one building on the previous one. This approach allows for the rapid development of a minimum viable product (MVP), which can be tested and refined based on user feedback. The agile methodology also allows for the quick identification and resolution of any issues that arise during the development process, ensuring that the final product is of the highest quality.

Furthermore, agile methodology allows for a more collaborative development process. Developers work closely with stakeholders to ensure that the software meets their needs and requirements. This ensures that the final product is not only functional but also user-friendly, with a great user experience (UX).

Building a Scalable Architecture

Using a scalable architecture for BNPL software development translates to equal measures of security, flexibility, and speed to support growth and offer additional features and functionality without compromising the UX. A scalable architecture is essential for BNPL software because it allows the platform to handle increasing traffic and data volumes as the platform grows.

Developers can use a microservices architecture to build a scalable BNPL software platform. This architecture involves breaking down the software into small, independent services that can be developed and deployed separately. This approach allows for greater flexibility and scalability, as each service can be scaled independently of the others.

Another way to build a scalable architecture is to use cloud computing. Cloud computing allows for the rapid deployment of new services and features, as well as the ability to scale up or down as needed. Cloud computing also offers built-in security features, making it an ideal choice for BNPL software development.

Ensuring Data Security and Privacy

Ensuring data security and privacy is a crucial factor in BNPL software development. It is essential that the platform identifies the user, manages secure data storage, and management. That is why our developers focus on PCI-DSS compliance, both for protecting sensitive payment card data and for keeping any stored data secure.

PCI-DSS compliance is a set of security standards established by the Payment Card Industry Security Standards Council. It is designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. Compliance with these standards helps to protect the platform and its users from data breaches and other security threats.

Developers can also use encryption to protect data in transit and at rest. Encryption is the process of encoding data in such a way that only authorized parties can access it. This ensures that even if data is intercepted, it cannot be read without the proper decryption key.

Finally, developers can implement multi-factor authentication (MFA) to further enhance security. MFA requires users to provide two or more forms of identification before they can access the platform. This makes it much more difficult for unauthorized users to gain access to the platform and its data.

Testing and Quality Assurance

Functional Testing for BNPL Features

Functional testing is a critical aspect of software development that ensures that the software application functions according to requirements and specifications. Functional testing involves testing essential features such as account creation, payment processing, and checkout to ensure that they work seamlessly. This type of testing is essential in identifying and fixing any issues that may arise during the development process, ensuring that the final product meets the client's needs.

Functional testing is usually done manually or through automation, depending on the complexity of the application. Manual testing involves a tester manually going through the application's features, while automation testing uses software tools to test the application's functionality.

Performance Testing for High Traffic Volumes

Performance testing is a type of testing that simulates high traffic volumes with traffic load applications to identify software performance variability, response times, reliability, and throughput under load scenarios. This type of testing is essential in ensuring that the application can handle high traffic volumes without crashing or slowing down.

Performance testing involves simulating different user scenarios to identify the application's performance under different load conditions. This type of testing can be done manually or through automation, depending on the complexity of the application.

Security Testing to Prevent Vulnerabilities

Security testing is a crucial aspect of software development that is aimed at identifying and fixing vulnerabilities before application release. Aspects such as network security, encryption, authentication, and authorization are essential to ensure that the platform is secure.

Security testing involves simulating different types of attacks to identify vulnerabilities in the application. This type of testing is essential in ensuring that the application is secure and can protect user data from malicious attacks.

In conclusion, testing and quality assurance are critical aspects of software development that ensure that the final product meets the client's needs. Functional testing, performance testing, and security testing are essential types of testing that must be carried out during the development process to ensure that the application is of high quality and meets the client's requirements.

Launching and Marketing Your BNPL Solution

Launching and marketing your BNPL solution requires careful planning, execution, and ongoing refinement to ensure that it meets regulatory standards, scales effectively, and delivers a seamless customer checkout experience. In this article, we'll explore some key strategies for preparing, promoting, and measuring the success of your BNPL solution.

Preparing for a Successful Launch

Before launching your BNPL solution, it's essential to ensure that you have a solid plan in place. This includes everything from choosing the right technology stack to complying with relevant regulations and ensuring that your solution is scalable and secure. You'll also need to work closely with your development team and other stakeholders to ensure that everyone is aligned on the goals, timelines, and expectations for the launch.

One critical factor to consider is the customer experience. Your BNPL solution should be easy to use, intuitive, and integrated seamlessly into your customers' checkout process. This means conducting thorough user testing and gathering feedback from real customers to identify any pain points or areas for improvement.

Promoting Your BNPL Software to Businesses

Once you've launched your BNPL solution, the next step is to promote it to businesses. This is a critical step in driving adoption and uptake, as businesses need to understand the value proposition of your solution and how it can benefit their operations.

One effective strategy for promoting your BNPL software is to provide businesses with customer behavior data insights. This can help them understand how BNPL software can have a positive impact on their business, such as by increasing sales, reducing cart abandonment rates, and improving customer loyalty.

Another key consideration is to ensure that your BNPL solution is easy to integrate into existing business processes. This means providing robust APIs and documentation, as well as offering support and training to help businesses get up and running quickly.

Measuring Success and Gathering Feedback

Measuring the success of your BNPL solution is critical to understanding what works and what needs improvement. This involves tracking key metrics such as usage rates, customer satisfaction, and user retention, as well as gathering feedback from customers and businesses.

Customer feedback can provide valuable insights into the user experience, such as whether the checkout process is smooth and straightforward, or whether there are any pain points or areas for improvement. Businesses can also provide feedback on how your BNPL solution is impacting their operations, such as by reducing costs, improving efficiency, or increasing sales.

By continually measuring success and gathering feedback, you can refine and improve your BNPL solution over time, ensuring that it remains relevant and valuable to your customers and partners.

Maintaining and Updating Your BNPL Software

Monitoring and Troubleshooting Issues

Real-time monitoring of system metrics is essential to ensure efficient BNPL operations while identifying and troubleshooting issues to maintain uptime for customers.

Implementing New Features and Improvements

While maintaining operational stability, BNPL software must continue improving its offering by adding new features, providing better user experience, and improving security.

Staying Ahead of Industry Trends and Regulations

Regulations and industry trends are constantly changing, thus the need to maintain compliance and ensure that the BNPL platform is up-to-date with new technical standards, encryption, and other evolving technologies.

Ready to launch your BNPL software? Contact us today to get a free consultation and get started!

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.